WEAT Rises While Stocks Fall

U.S. stocks dropped sharply on Monday, marking the fifth consecutive week of losses for all three major U.S. stock indexes. The Dow declined 1.5%. Meanwhile, the S&P 500 fell 2.4%. The Nasdaq Composite dropped roughly 3.2%. The 10-year Treasury note hit 3.19%, its highest yield since late 2018.

“The Ukraine war, a global energy shock and the risk the Fed tries to fight the supply-driven inflation have sparked a reassessment of macro scenarios among market participants,” Blackrock analysts wrote in a note Monday morning. “We also see little chance of a perfect economic scenario of low inflation and growth humming along.”

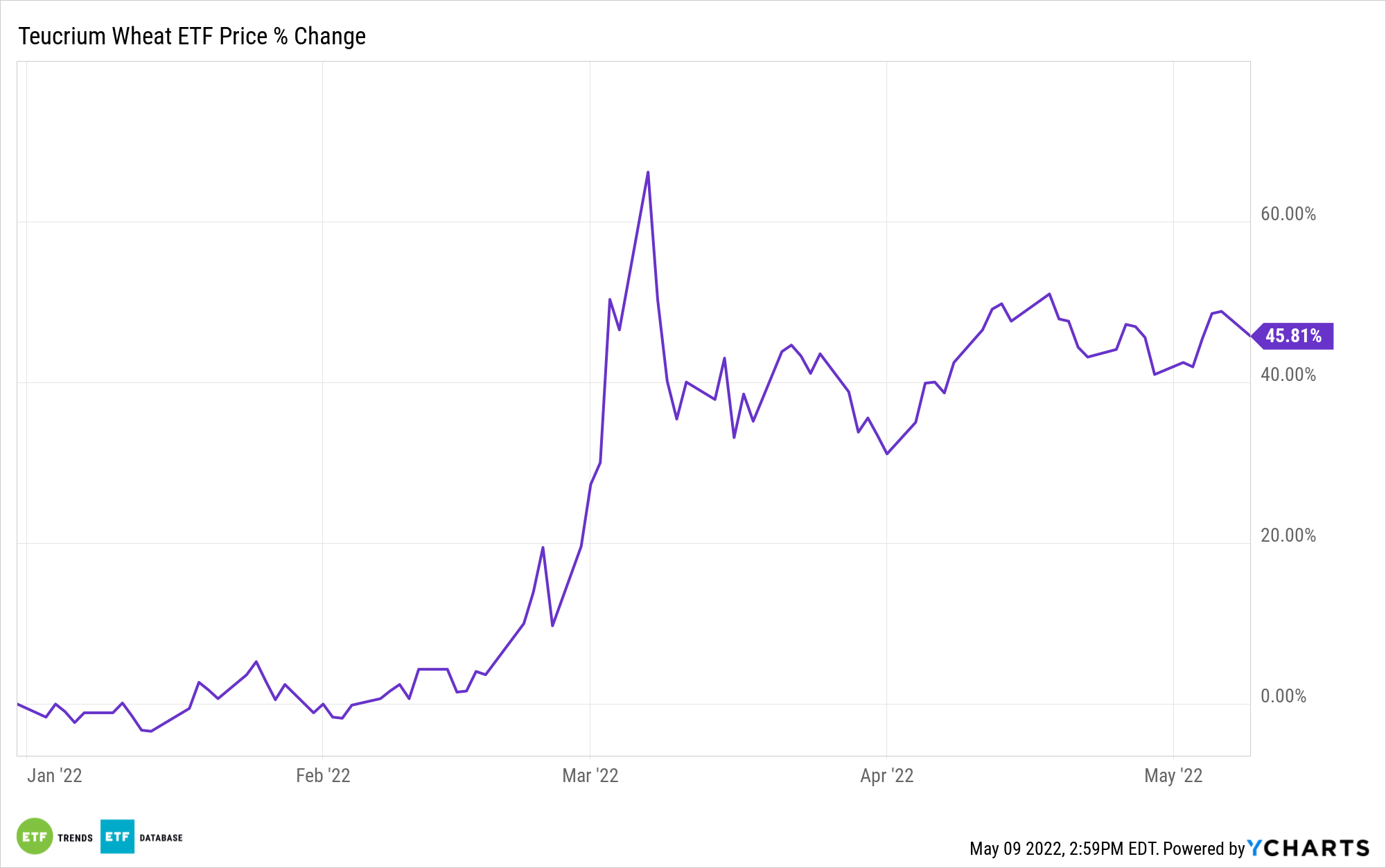

But while the S&P 500 fell to a new 52-week low and as investors and analyst brace for a recession, grains historically have low correlations to the S&P 500. Demonstrating this point, as the S&P 500 has been down 16.79% since the beginning of the year, theTeucrium Wheat Fund (NYSEArca: WEAT)has gained nearly 46% year-to-date.

WEAT offers exposure to wheat futures contracts. Because the underlying index consists of wheat futures contracts, factors such as the slope of the futures curve and the current level of interest rates will impact the performance of WEAT.

One distinguishing factor of WEAT is the structure of its underlying holdings: instead of concentrating holdings in front month futures, WEAT spreads futures contracts across multiple maturities. That is done with the objective of minimizing the impact of contango on bottom line returns.

Like many exchange-traded commodity products, WEAT should not be expected to deliver exposure to spot wheat prices.

Tags: Ukraine, prices, wheat, stocks, U.S., futures, contracts, dropped

Read also

Growing demand for corn in Vietnam points to increased imports

BLACK SEA GRAIN. KYIV conference brought together grain market participants and ex...

Argentina bug invasion knocks $1.3 billion off corn crop

Growth of corn prices in Ukraine limits the fall in world prices

Argentine farmers call for ‘urgent’ end to wheat export taxes

Write to us

Our manager will contact you soon