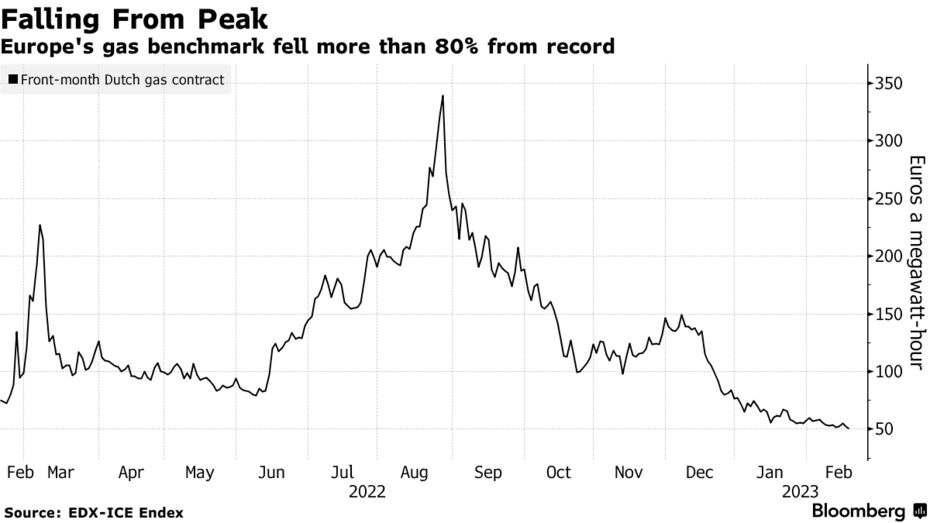

European Gas Falls Below €50 as Historic Energy Crisis Recedes

European natural gas futures slumped below €50 for the first time in 17 months as the region’s worst energy crisis in decades recedes, but signals emerge that further price declines are unlikely.

Prices have plunged by more than 80% from their August peak when Russia’s gas cuts hit Europe with about $1 trillion in costs, hammering the region’s economy and pushing inflation to the highest in decades. Now, the continent is seeing a sharp turnaround as relatively mild weather, efforts to reduce energy consumption and strong inflows of liquefied natural gas from the US to Qatar take the edge off.

However, analysts question whether the decline in prices will persist much further. With the end of winter approaching and heating demand receding, lower prices could make gas more economical for power generation in Europe than alternatives such as coal.

“Gas prices have fallen into the fuel switching range suggesting that it is now more profitable to run the highest efficiency gas plants in comparison to the lowest efficiency coal plants,” Stefan Ulrich, an analyst at BloombergNEF, said.

Demand is also picking up from India to China. Prices could also rise if there is extended cold weather before the end of winter or if there are supply disruptions.

“We’re getting to a level where the downside is probably more limited whereas still there’s clearly upside, particularly if you get the strong economic growth in China,” said Steve Hill, executive vice president for energy marketing at Shell Plc, in a presentation on Thursday. “We are clearly approaching that range.”

Benchmark front-month futures dropped as much as 6.2% to €48.78 a megawatt-hour, to the lowest intra-day level since Aug. 31, 2021. The contract lost about 35% so far this year, but is still about double the usual levels for this time of year.

For now, high storage levels are providing a buffer for Europe, a sign of optimism that the region can make it through this winter and next. With most of usual Russian gas volumes now absent, European nations appear to have adjusted with ample replacement options.

Germany utility Uniper SE — which was rescued by the government last year after the energy crisis put it on the brink of collapse — said on Friday that it will overcome the problems generated by Russian gas cuts by 2024 at the latest, with high costs for replacing the lost volumes remaining an issue.

Recent price declines have helped the company to significantly reduce its losses, though it still recorded negative net adjusted earnings before interest and taxes of €10.9 billion for 2022.

Northwest Europe’s LNG futures fell to $15.25 per million British thermal units on Thursday, the lowest since the contract started trading on ICE Dec. 5. That’s also near the price level when China’s buyers could return to the market, said Tobias Davis, head of LNG for Asia at brokerage Tullet Prebon.

Write to us

Our manager will contact you soon