Will China’s Record Purchases Set Sail?

China’s hunger for U.S. corn looks to be substantial in 2021.

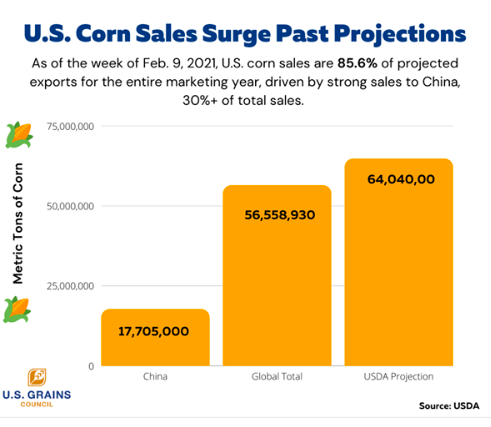

The U.S. Grains Council says corn sales are surging past trade expectations, and as of this week, corn sales are at 85.6% of the projected exports for the entire marketing year. Much of that was boosted by China coming in with a record week to close January.

“The sales were massive,” says Ryan LeGrand, president and CEO of the U.S. Grains Council. “We saw the second-largest single corn purchase on record that we have.”

The second-largest single corn purchase was made on Friday, Jan. 29, but what’s interesting about that is China didn’t even need to make Friday’s sale to hit a record for the week. By Thursday, China had already reached a new weekly record.

As the substantial demand looks to be rooted in a need for feed and food, corn purchases from China may not be over yet and could be on track to hit a new record.

“The potential is there,” says LeGrand. “I don’t want to jinx it by saying this, but I think we can do it, and shipments need to really pick up. We need to see those shipments, but I think we can get it done.”

University of Missouri economist Ben Brown says while purchases are on a record pace, actual shipments are not.

“We remain below the seasonal pace needed to hit that, and we had a strong week last week of inspections. Last week was a strong export week,” he says.

Brown says export inspections need to pick up pace in order to meet the growing Chinese demand.

“I think that China will take these corn shipments; they need corn,” adds Brown. “We saw USDA increase Chinese corn imports, up to 24 million metric tons. Some would argue that USDA is finally reaching reality where other people have been. Other people would probably suggest that it should be higher.”

The U.S. Grains Council is also voicing confidence the strong demand will result in shipments.

“I want to go back to that demand picture that we’re seeing there and the need for corn,” adds LeGrand. “I think they’re going to execute on these contracts, and they’re going to ship.

Farmer Mac chief economist Jackson Takach agrees with that sentiment. He believes the purchases by China will ship, as economics still encourage buying from the U.S.

“It’s a world price issue, so there’s really nowhere else to get the corn,” says Takach. “If you need the corn, you’re going to buy it from us. There’s really no reason not to. It’s not an economic reason that you could switch your port of sale and somehow get a better deal. And to cancel the sales, there would have to be an economic driver to it, and I don’t see one at this time.”

Aggressive demand by China is what’s supporting corn prices right now. Takach cautions if demand starts to wane for any reason, corn prices could follow.

Read also

Oilseed Season 2025/26: Déjà Vu or New Chapter?

Nigeria, Brazil sign $1 billion deal to boost agriculture, energy

Corn exports from Ukraine in MY 2025/26 will increase by 3 mln tons

Feed wheat supplies are disappearing from the Black Sea markets, demand prices hav...

China’s feed production rises, soybean meal consumption falls

Write to us

Our manager will contact you soon