Where could the US-Mexico GM corn dispute end up?

The recent announcement by the Office of the US Trade Representative (USTR) that it was requesting technical consultations with Mexico under the Sanitary and Phytosanitary Measures (SPS) Chapter of the United States-Mexico-Canada Agreement (USMCA), is the latest step in the ongoing dispute over Mexican efforts to ban imports of genetically modified (GM) corn (Office of USTR, March 6, 2023).

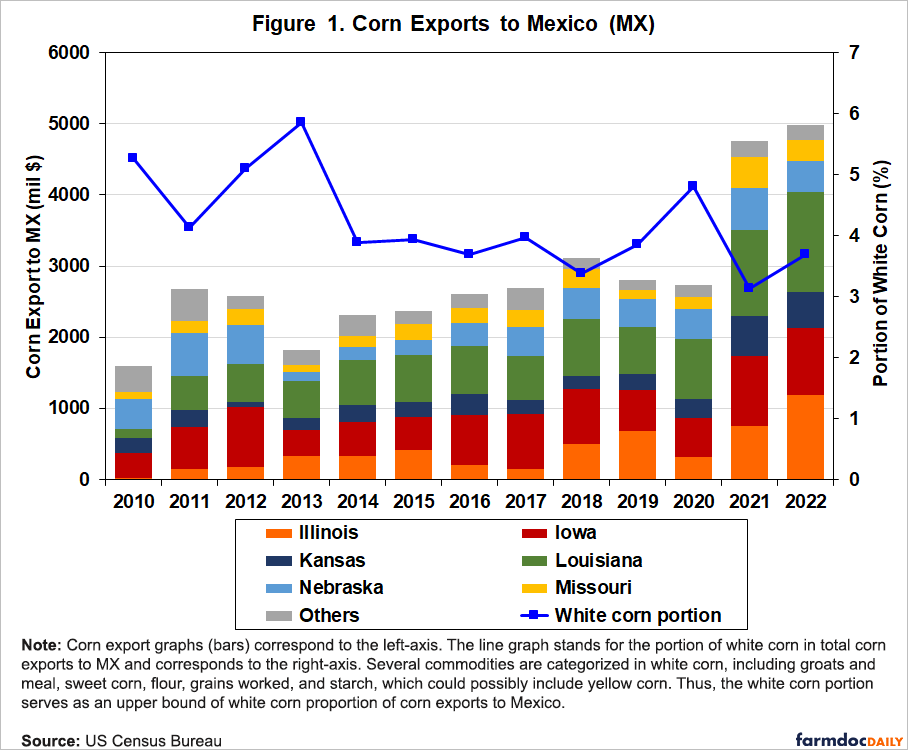

The dispute has its origins in a decree issued by the Mexican President Andrés Manuel López Obrador on December 31, 2020, calling for GM corn for human consumption to be phased out by the end of January 2024. Not surprisingly, given Mexico is the second-largest export market for US corn totaling $4.792 billion in 2022 (USDA/FAS, 2021), with about 17 million metric tons of yellow corn crossing the border annually (USDA/ERS, December 13, 2022), the original decree ratcheted up trade tensions between the two countries. Following US pressure, Mexico scrapped the 2024 deadline banning GM corn for animal feed and industrial use on February 13, 2023, all the while retaining the ban on its use for human consumption.

Despite these changes, the recent move by USTR is essentially the first step in the process by which the USMCA dispute settlement mechanism is triggered, once other efforts/mechanisms to resolve the issue have failed – specifically, in its response to a letter from USTR, Mexico did not “…allay US concerns with Mexico’s measures concerning [genetically engineered] GE corn….Therefore, the United States does not consider that further use of other mechanisms would resolve the matter…” (Ambassador Katherine Tai, USTR, March 6, 2023).

Like the World Trade Organization (WTO), USMCA has a defined legal process by which trade disputes involving its member countries are to be settled. Once other procedures have been exhausted, technical consultations are the first stage of the process, USTR appealing to Chapter 9 of the USMCA (USMCA Agreement, Chapter 9) addressing SPS measures,

“…Pursuant to Article 9.19.2, the United States requests technical consultations with Mexico with regard to Mexico’s measures concerning genetically engineered (GE) corn and certain other GE products. These measures may adversely affect U.S. trade with Mexico and appear to be inconsistent with Mexico’s commitments under the Sanitary and Phytosanitary (SPS) Measures chapter of USMCA…” (Ambassador Katherine Tai, USTR, March 6, 2023)

Substantively, USTR is arguing that in seeking to implement its regime on GM corn imports, Mexico is violating its commitment to ensure any SPS measures are “…based on relevant scientific principles…” (Article 9.6.6(b)), and an “…approval procedure that requires a risk assessment…” (Article 9.6.4 (a)). Therefore, the United States and Mexico should meet with “…the aim of resolving the matter cooperatively…” (Article 9.19.3)

If this fails, under Chapter 31 of USMCA (USMCA Agreement, Chapter 31) concerning dispute settlement, the United States can seek establishment of an independent panel to investigate and rule on Mexico’s measures relating to GM corn, which, once constituted, would be expected to present its initial report within 150 days (Article 31.17.1). After a further period of 60 days, allowing for country comments and finalization of the report, the report would be made public (Article 31.17). Assuming the panel rules against Mexico, resolution of the dispute should then occur within 45 days, Mexico either removing its GM corn measures, providing compensation to the United States, or provision of some other remedy (Article 31.18.2). If Mexico fails to implement the panel ruling, the United States would be allowed to suspend trade benefits with Mexico equivalent to the damage caused by the latter’s GM corn measures (Article 31.19.1), most likely in the form of a tariff(s) against specific Mexican products.

In thinking about how a USMCA panel might rule, it is important to note the chapter on SPS measures draws heavily on the approach applied in the WTO’s own SPS Agreement, the definitions contained in the latter being incorporated into the USMCA chapter on SPS measures. Therefore, while the United States is not expected to file a complaint against Mexico under WTO rules, it seems reasonable to argue the 2006 WTO ruling in favor of the United States against the European Union’s (EU) regulation of GM crops would likely influence any USMCA panel ruling. The WTO panel found the safeguard measures implemented by six EU member states against the import of specific GM crops, were not based on a risk assessment as required under the WTO’s SPS Agreement (Sheldon, 2007). In other words, a USMCA panel is very likely to find for the United States against Mexico on the grounds that Mexico has not applied scientific principles and appropriate risk assessment in seeking to ban the import of GM corn.

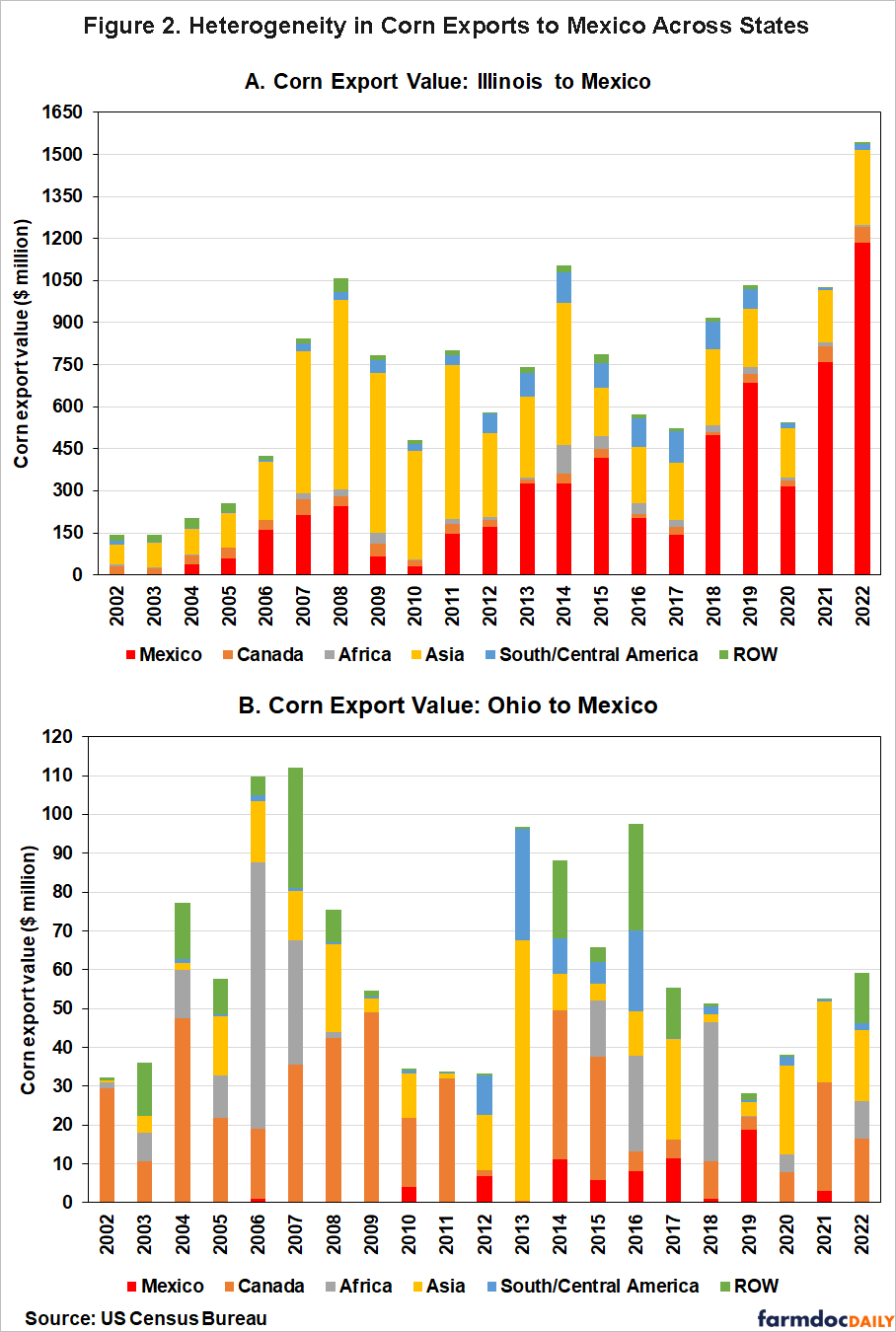

The direct economic impact of not resolving this dispute on the US corn market would likely vary across US states, depending on the proportion of their exports going to Mexico. In particular, given the small proportion of white corn in US corn exports to Mexico, many states can be expected to see a limited effect of the dispute in the short term. However, the top-6 states in corn exports to Mexico, Illinois, Louisiana, Iowa, Kansas, Nebraska, and Missouri, would likely be influenced considerably by this event (see Figure 1). The heterogeneity in Mexico’s corn import share between US states lends support to this prediction. For instance, over the last two years, Mexico accounted for more than 70 percent of corn exports from Illinois, compared to only 2 percent of corn from Ohio (another major corn-producing state but not in the top 6 corn exporting states to Mexico) being exported to Mexico (see Figure 2).

In the longer term, two broader factors could result in substantial indirect impacts on US farmers. First, there would likely be a “ripple” effect as additional supplies are diverted to the domestic market, driving down corn prices. As a result, US corn farmers would likely see increased risk of a squeeze on their margins. Second, and more broadly, if this dispute is not resolved in favor of the United States, it would introduce considerable regulatory uncertainty, with the potential of undermining the stable operation of commodity markets. This could increase the cost of any risk management measures such as hedging and options, placing further financial strain on US grain producers.

The dispute between the United States and Mexico over the latter country’s proposed ban on imports of GM corn for human consumption has reached the point where the United States has made an initial step towards seeking a panel ruling through the dispute settlement mechanism of USMCA. If a panel investigation goes ahead, our expectation is that it will rule in favor of the United States. Crucially, ending the dispute matters to US farmers from states that have significant corn exports to Mexico, as well as to other farmers whose margins would likely come under significant pressure if the ban is enforced. This is also a major test for the SPS Chapter of USMCA to which the United States, Mexico and Canada have all signed up.

Citation:

Sheldon, I., S. Lee and C. Zoller. “Where Could the US-Mexico GM Corn Dispute End Up?” farmdoc daily (13):65, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 7, 2023.

Read also

Ukraine is ready to help Syria prevent food crisis – Zelenskyy

Join with the EARLY RATE – 22 International Conference BLACK SEA GRAIN.EUROP...

Brazil sugar output decreased by 23% — Unica

Algeria imposes a complete ban on durum wheat imports in 2025

Weather in Brazil and Argentina remains favorable for the future harvest of soybea...

Write to us

Our manager will contact you soon