US: Soybeans pushing out wheat and corn

Plenty happens in terms of new crop data releases in April and May. The USDA starts producing Crop Progress reports and the first World Agricultural Supply and Demand Estimates (WADSE) for 2024-25 come out in early May.

Initial acreage estimates give the market an idea of where the USDA might peg their first production estimates for the US, and whether supplies might be up or down. Plenty can change between the release of acreage estimates and the end of sowing. Weather and prices change and with them producers sowing intentions. However, acreage estimates are still a good start.

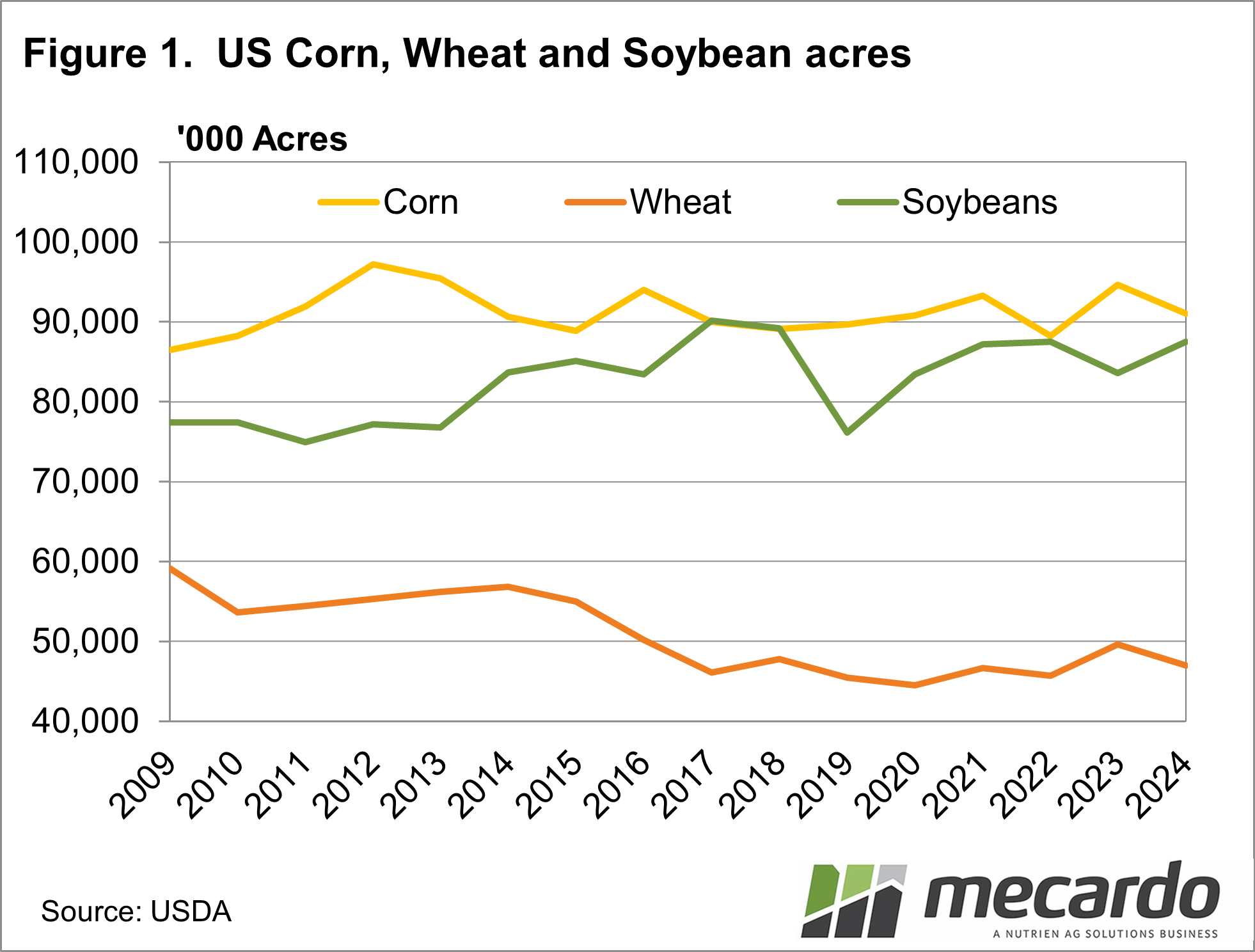

Figure 1 shows actual acreage numbers for US corn, soybeans and wheat, along with an estimate for 2024. Usual crop rotations and earlier price relativities have the USDA forecasting a 4.7% increase in soybean acreage. The increases in soybeans come at the expense of corn and wheat, with acreage down 4% and 5.8% respectively.

Total acreage is expected to be down 1% for the three major crops, so it really is just a shift towards soybean production. Over the last ten years, we have seen a shift away from wheat, towards soybeans in the US, likely driven by price.

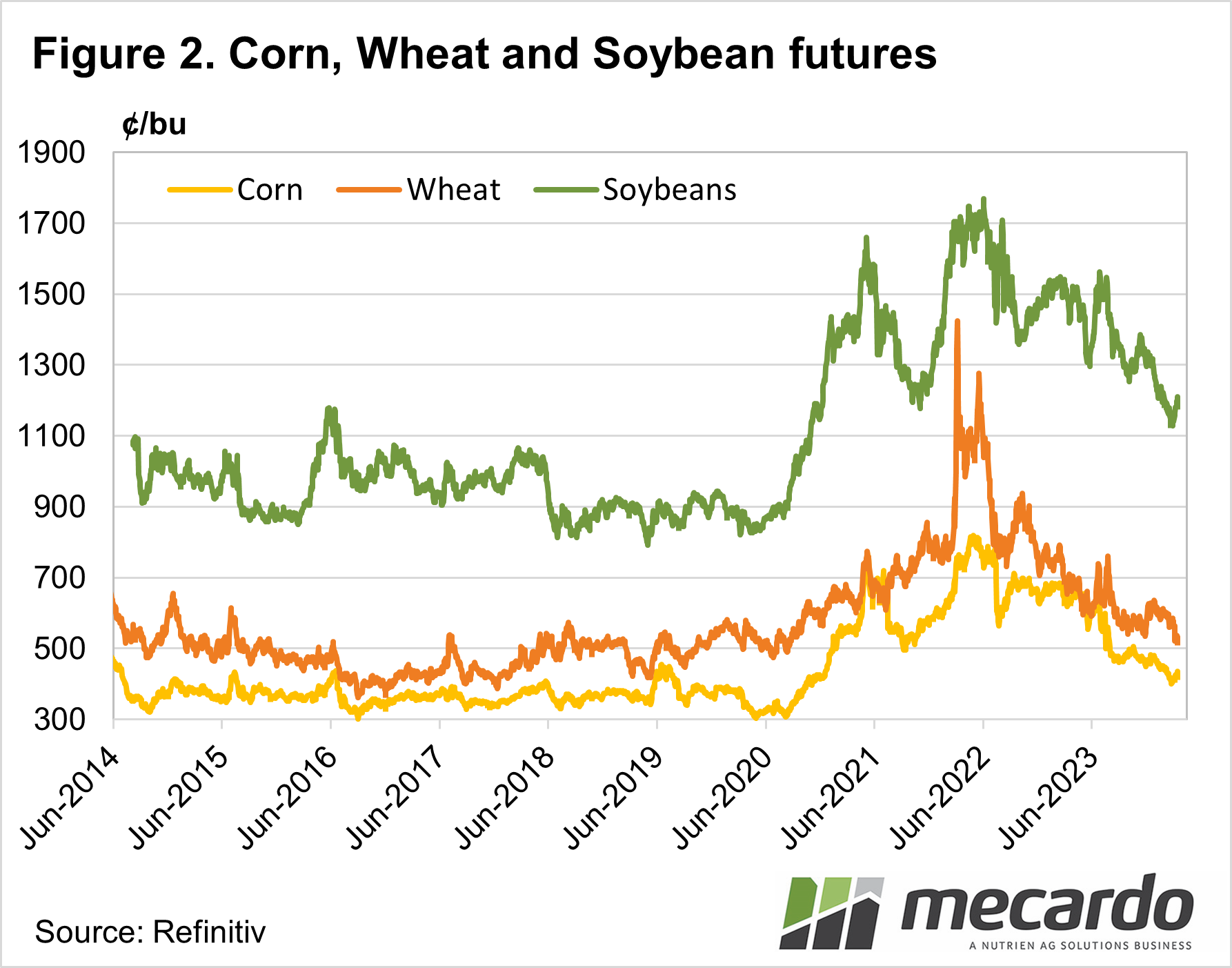

Figure 2 shows the CBOT Futures price for corn, wheat and soybeans over the past 10 years. In late 2020 and into 2021 soybeans moved to a stronger premium to corn and wheat than it had held over 2018 and 2019. The Ukraine war wheat spike of 2022 saw the premium narrow, with all three sliding significantly since.

So far in 2024 soybeans have held an average 162% premium to corn. This time last year the average premium had been 118%. This is a pretty good reason for US spring croppers to put in more soybeans and less corn where they can.

Read also

Join with the EARLY RATE – 22 International Conference BLACK SEA GRAIN.EUROP...

Brazil sugar output decreased by 23% — Unica

Algeria imposes a complete ban on durum wheat imports in 2025

Weather in Brazil and Argentina remains favorable for the future harvest of soybea...

Ukrainian flour exports are 35% behind last year’s volumes

Write to us

Our manager will contact you soon