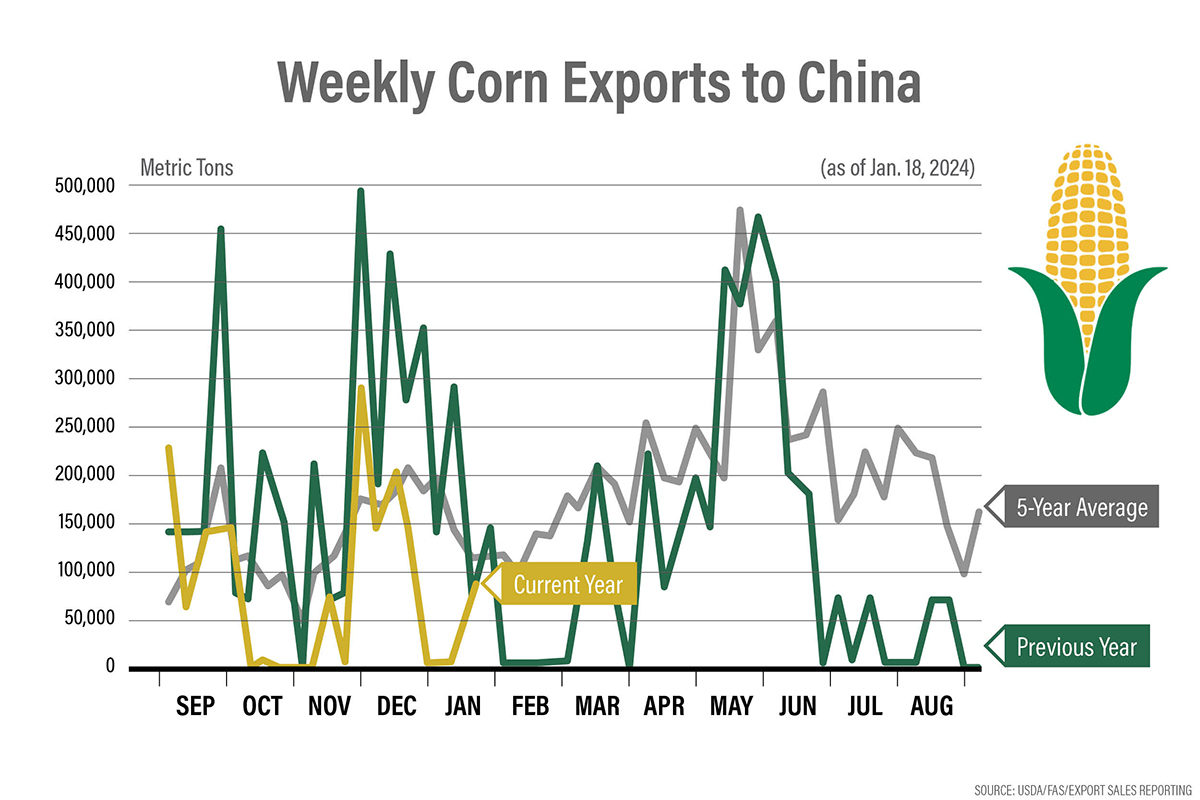

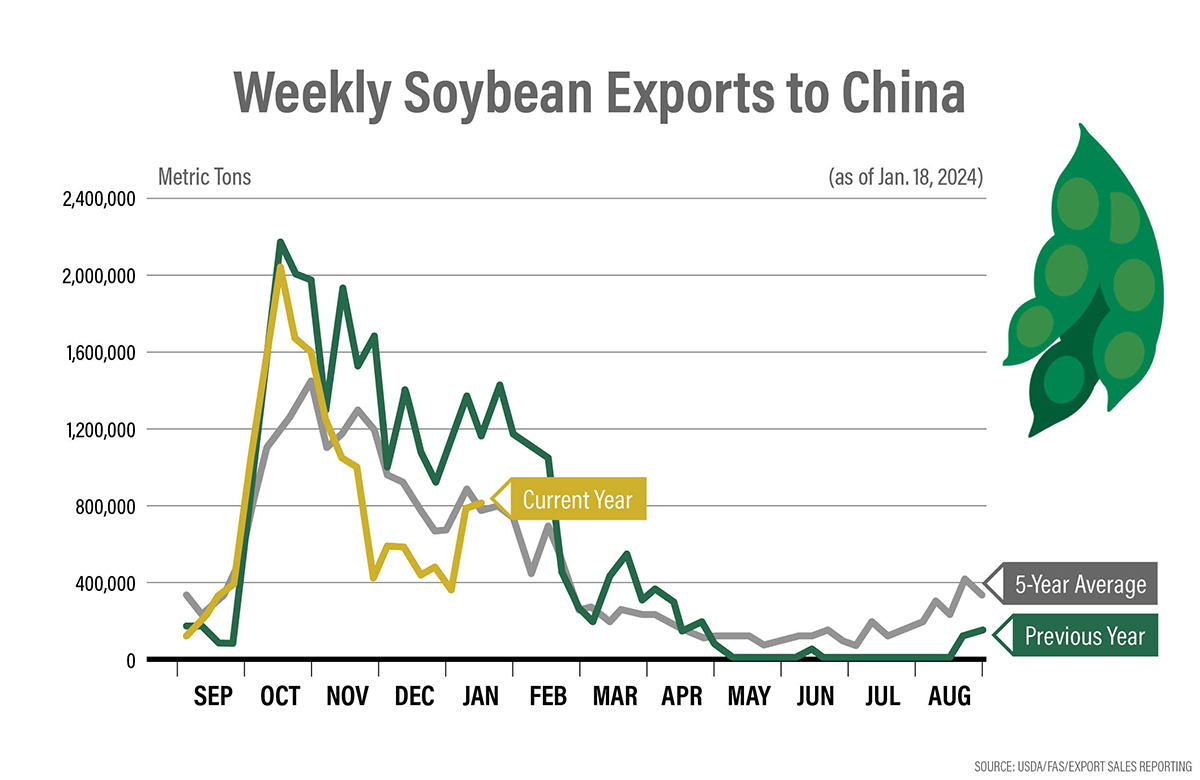

Economic Uncertainty in China Slows Demand for U.S. Corn and Soybeans

Signs of economic slowdown have been mounting in China for months, and some experts say the country is teetering on a recession. On Monday, news broke of the insolvency of property giant China Evergrande Group, the world’s most indebted real estate developer, with more than $300 billion of total liabilities.

Kent Beadle with Paradigm Futures says Evergrande has been in trouble for a very long time but was told by a Hong Kong Court it’s time to liquidate. The news has spurred fears the Chinese economy might significantly dip, which would have some impact on demand for U.S. ag commodities.

Last week, the Chinese government surprisingly stepped in with additional economic stimulus efforts announcing fund injection of 2 trillion yuan to stabilize the stock market. Plus, China’s Central Bank made the biggest cut in more than two years to the amount of cash banks must hold as reserves to free up 1 trillion yuan to the market.

The market response was initially positive, but it didn’t hold. Mike Zuzulo with Global Commodity says that’s because Asian markets on Thursday night and Friday morning just didn’t get done what they needed to.

“The Hong Kong stock market didn’t rally above resistance and the offshore Chinese currency didn’t rally above resistance either, so I felt like the macro demand side of the equation was a really big player,” he explains.

The World Bank is projecting China’s growth or GDP at 4.5% this year, the slowest in 30 years. This could curb U.S. exporters further in 2024.

Write to us

Our manager will contact you soon