Downstream palm oil margins diverge: Malaysia strengthens, Indonesia tightens

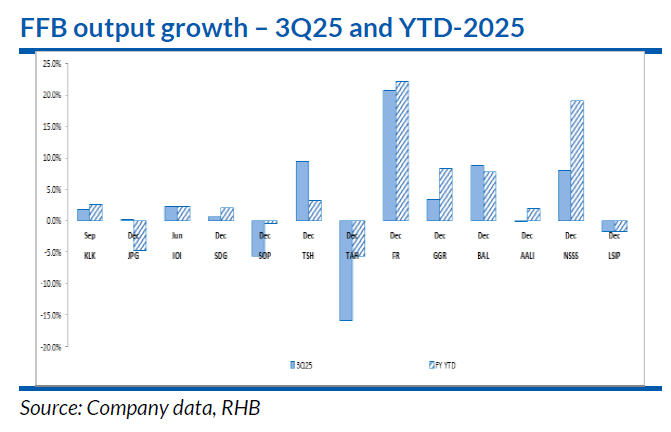

The sector’s quarter three 2025 (3Q25) earnings were largely above expectations. RHB expects net profit to moderate quarter-on-quarter (QoQ) in 4Q25, from lower crude palm oil (CPO) and palm kernel (PK) prices, as well as lower QoQ output in Malaysia, albeit offset by higher QoQ output in Indonesia.

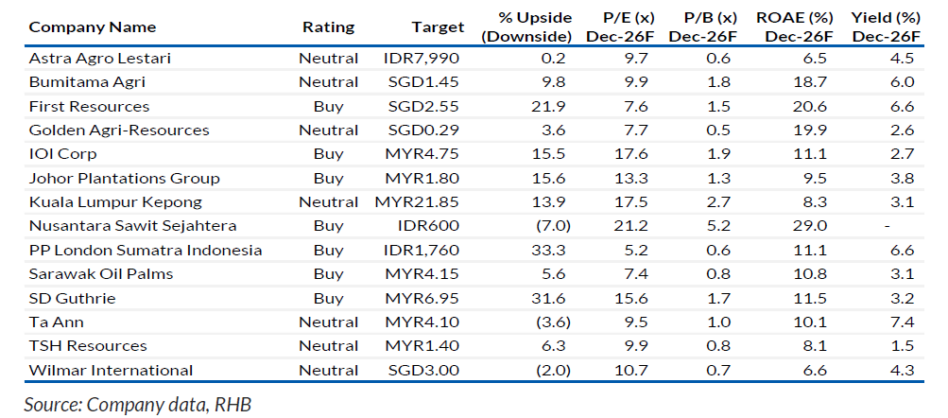

“We maintain a NEUTRAL weighting on the sector,” said RHB. In Malaysia, for companies under coverage, FFB output rose 12.5% QoQ or 0.7% year-on-year (YoY).

Malaysian planters expect 4Q25F output to moderate QoQ, with the peak month being October, with most maintaining their midsingle-digit FFB growth forecasts for 2025.

For Indonesia, RHB saw an average 5.3% QoQ or 6.2% YoY output growth in 3Q25 for the companies we cover, bringing the nine months 2025 (9M25) growth to 7.7% YoY.

The strong YoY recovery in Indonesia was due to improvements following the impact of El Nino, which affected output in 9M24, while the QoQ growth stemmed from a mini output peak recorded in Indonesia in July.

Going forward, most Indonesian players expect to see QoQ output growth in 4Q25. This is anticipated to be the peak quarter for the year, and are keeping their mid- to high-single-digit growth for 2025.

In Indonesia, the price of CPO rose 5% QoQ or 0.7% YoY, while PK prices rose 4% QoQ or 34% YoY. For Indonesia planters with downstream operations, margins weakened QoQ from a narrower tax differential between upstream and downstream products of USD76 per tonne.

“YoY, however, we saw margins improve as the tax differential widened by 23% YoY from USD62 per tonne in 3Q24,” said RHB.

In Malaysia, RHB saw mostly all downstream players recording wider QoQ margins, due to competition from Indonesia.

Going forward, most planters are guiding for refining margins to remain tight, while there are volume improvements for further downstream products in Europe.

For almost 30 years of expertise in the agri markets, UkrAgroConsult has accumulated an extensive database, which became the basis of the platform AgriSupp.

It is a multi-functional online platform with market intelligence for grains and oilseeds that enables to get access to daily operational information on the Black Sea & Danube markets, analytical reports, historical data.

You are welcome to get a 7-day free demo access!!!

Read also

Black Sea Export Strategies Within the Pressure of the Global Food Market

American mill will buy wheat from Argentina because it is cheaper than local

Germany plans to import biomenthane from Ukraine

China pressures Iran to block Strait of Hormuz

First Food from Ukraine agrohub will be launched in Ghana

Write to us

Our manager will contact you soon