CPO discount to soybean oil seen lasting up to one year, says Pacific Inter-Link

Crude palm oil (CPO) exporter Pacific Inter-Link Sdn Bhd (PIL) expects the discount of palm oil to soybean oil to persist for the next six to 12 months, due to tight soybean oil supply from the US and South America and a gradual rise in palm oil production.

This will enhance palm oil’s price competitiveness and likely boost demand from major buyers like India and China as well as Pakistan, and several African nations, according to PIL chairman and group regional managing director Datuk Fouad Hayel Saeed Anam.

“Demand fundamentals for soybean oil remain robust, particularly with its usage in biodiesel in the US and South America. On the other hand, palm oil production in key countries like Indonesia and Malaysia is recovering, contributing to more consistent supply. This dynamic is likely to keep palm oil prices trading at a discount relative to soybean oil,” he says in an interview with The Edge.

The world’s most abundant edible oil has been trading at a discount to soybean oil since early April this year, a shift that is expected to boost demand in price-sensitive markets.

This marks the end of an unusual five-month period — from last November to March this year — during which CPO futures traded at a premium to its closest competitor, driven by supply concerns stemming from floods in major producers Malaysia and Indonesia, along with Indonesia’s move to raise its biodiesel blending mandate to 40%.

“Generally soybean oil is always [traded] at a premium to palm as the oil yield of soy is very low and generally soybean meal is in high demand for animal feed,” says Fouad.

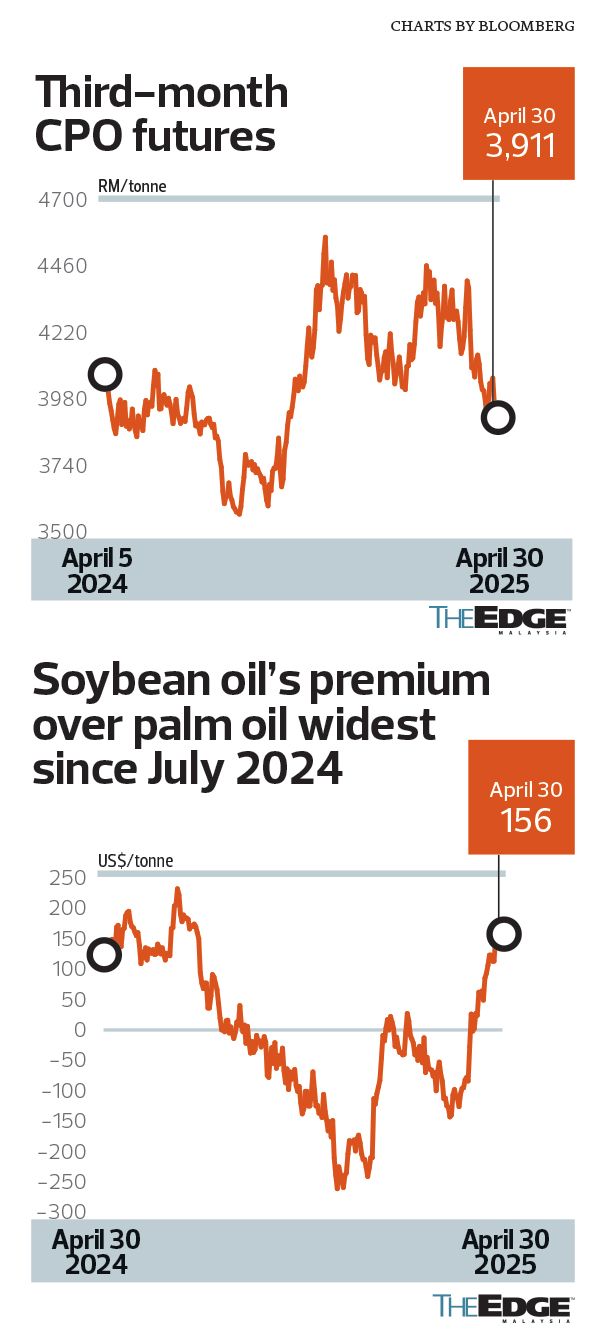

According to Bloomberg data, soybean oil’s premium over palm oil has widened to about US$156 (RM673) per tonne at the time of writing. This is the largest gap since July 24, 2024, when the premium stood at US$160 per tonne.

This contrasts with the period when soybean oil was cheaper than palm oil, trading at a discount of about US$100 per tonne in November and US$200 per tonne in December 2024. Between February and March this year, the discount ranged from US$15 to US$143 per tonne.

Could soybean oil revert to a discount to palm oil again? “Yes, this could happen based on several factors like demand, supply, supply chain challenges, oil prices and biodiesel mandates,” he adds.

CPO futures on Bloomberg showed prices peaking at RM4,463 per tonne on Feb 19, before falling more than 12% to RM3,911 per tonne at the time of writing. This price drop — combined with global equity market weakness driven by uncertainty over US trade policy — also saw the Bursa Malaysia Plantation Index drop over 4% from its peak of 7,609.70 on Feb 28.

Assuming no major weather disruptions or geopolitical shocks, average CPO prices are projected to remain between RM3,700 and RM4,200 per tonne over the next six to 12 months, says Fouad.

PIL is a subsidiary of the Dubai-based multinational company HSA Group — founded by Fouad’s late father Hayel Saeed Anam — which reported revenue of about US$10 billion.

Incorporated in 1998 in Kuala Lumpur, PIL is a leading player in the palm oil supply chain, exporting to over 70 countries with a diverse product portfolio that includes edible oils, fats, soaps, detergents and dairy products. Its three largest markets are Turkey, Egypt and Saudi Arabia.

The company owns several popular soap brands, including Juliet, Soft Silk, Saba and Medi Twist, which are well known across many African markets. In the dairy segment, PIL’s Milgro brand leads the market in Algeria, Sub-Saharan Africa and the Middle East.

The company sources CPO and refined products either through its own refineries or from third-party suppliers in Malaysia and Indonesia — including SD Guthrie Bhd (KL:SDG) — in full compliance with the specifications of the Palm Oil Refiners Association of Malaysia (Poram).

PIL operates one refinery in Kulai, Johor (Pacific Oils & Fats Industries Sdn Bhd) and four more in Indonesia: in Dumai (PT Pacific Indopalm Industries), West Kalimantan (PT Pacific Bio Industry) and Medan (PT Pacific Palmindo Industri and PT Pacific Medan Industri). Together, these facilities have a combined refining capacity of 9,000 tonnes per day.

PIL recorded stable year-on-year revenue growth of 8% to 12% over the past three years. For 2024, it surpassed US$3 billion in revenue, driven by strong performance in Turkey and the Middle East and North Africa (Mena) region.

Fouad is optimistic that this positive momentum will continue, as the group expands into new markets such as Central Asia (Kazakhstan and Uzbekistan) and South America (Brazil and Argentina), amid growing demand for speciality palm oil-based products.

“Over the last 30 years, we have built a loyal customer base that depends heavily on our supplies. This is what makes us different — our strong presence in destination markets sets us apart when it comes to marketing, sales, trading and exports,” Fouad explains.

“We aim to increase our export share to 20%, representing an estimated 25% to 28% growth compared to 2024, based on projected tonnage and market penetration. We expect to ship between 3.3 million and 3.5 million metric tons in 2025.”

When asked about export shipment disruptions to the US amid recent tariff uncertainty, Fouad acknowledges some temporary delays while PIL awaits clarity on the financial impact of newly imposed tariffs.

The US had temporarily suspended its 24% reciprocal tariff on Malaysian goods for 90 days, applying a lower 10% standard tariff instead during this period.

“There have been temporary disruptions due to policy uncertainties. We have not paused exports entirely, but we’ve recalibrated volumes pending clearer guidelines and tariff adjustments,” says Fouad.

Although the US market accounts for less than 5% of PIL’s total export volume, Fouad sees it as a strategic growth market. “We see the US as a growth market, despite the challenges. We will continue to monitor the situation closely.”

As part of its sustainability efforts, PIL aims to raise its traceability to plantation (TTP) to 80% by year end from the current 64%, in preparation for the European Union Deforestation Regulation (EUDR). Achieving full traceability, however, remains a lengthy and intensive process, says Fouad.

TTP refers to the ability to trace palm oil back to the specific plantation where the oil palm fruit was grown. This traceability ensures the oil is sourced legally, responsibly and without contributing to deforestation — an essential requirement under sustainability frameworks like the EUDR.

To ensure responsible sourcing, Fouad says PIL only purchases CPO from certified mills, even though it often receives lower-priced offers from uncertified suppliers. “We’ve made a clear, group-wide commitment to sustainability, choosing long-term compliance over short-term cost savings.”

In line with its traceability goals, PIL is leveraging satellite technology and geospatial data to monitor land-use changes and reduce deforestation risks.

“At PIL, we are leveraging technology to improve our supply chain via MapHubs — a technology company specialising in software and services that assist organisations in monitoring deforestation risk. We utilise their satellite monitoring platform to enhance supply chain transparency and compliance such as real-time deforestation notifications, supply chain mapping and grievance tracking related to PIL’s supply chain. We are also investing in AI-based demand forecasting to optimise inventory and production cycles,” says Fouad.

For almost 30 years of expertise in the agri markets, UkrAgroConsult has accumulated an extensive database, which became the basis of the platform AgriSupp.

It is a multi-functional online platform with market intelligence for grains and oilseeds that enables to get access to daily operational information on the Black Sea & Danube markets, analytical reports, historical data.

You are welcome to get a 7-day free demo access!!!

Read also

Abbey Commodities – General Partner of BLACK SEA GRAIN.KYIV-2026

Export Logistics Reset 2026: Rail Tariffs, Capacity Pressure and New Trade Reality

Corn prices in Ukraine dropped to $212–213/t

India’s palm oil imports rose 51% in January, reaching a four-month high

Morocco expects grain harvest to double following heavy winter rains

Write to us

Our manager will contact you soon