Brazil Soy Planting Growth Slowing, Argentina Accelerating

Argentina could see the largest expansion of soybean planting in more than a decade in the 2024-25 planting season, while Brazil’s soybean plantings are expected to grow at the slowest pace in a decade during the same time frame.

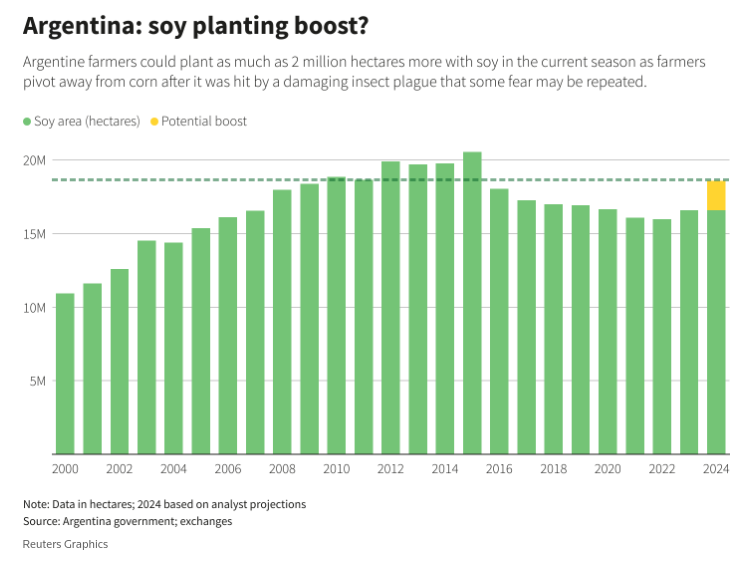

Reuters’ Maximilian Heath reported that “Argentine farmers are likely to plant more soybeans in the current 2024/25 season, trimming the area dedicated to corn after that crop’s last harvest was hit by a devastating insect plague and with rain forecasts looking rosier for soy. The trend could see the largest expansion in soy planting in over a decade, analysts said, potentially boosting supplies globally with prices already subdued. Argentina is the world’s top exporter of processed soymeal and oil.”

At the same time, Reuters’ Karen Braun reported that “this year’s price slump has the oilseed looking less attractive than normal to Brazilian producers, though a record crop and the further padding of global supplies may be inevitable. China’s COFCO International on Tuesday said the firm expects Brazil’s soy plantings in 2024-25 to grow at the slowest pace in a decade due to lower profit margins for farmers, similar to the theory offered earlier this year by the U.S. Department of Agriculture.”

Heath reported that Argentina’s “soy planting area has declined in recent years, competing with corn for space. But fears that a leafhopper plague like one that ravaged the last corn harvest could hit the fields again is likely to knock an estimated 2 million hectares (4.9 million acres) off corn planting – favoring soy.”

“‘Of those 2 million hectares of corn not being planted, a large part will go to soybeans,’ said Cristian Russo, head of agricultural estimates at the Rosario grains exchange, which estimates 16.8 million hectares were planted with soy last year,” Heath reported. “Aníbal Córdoba, a farmer and member of a growers group present in northern provinces including Chaco and Santiago del Estero, said producers were building more soy into their plans.”

“‘Our group usually plants 35% to 40% of our land with corn, but this time we’re going to do an average 20-25%. Of what’s not going to corn, almost all will be replaced with soy,’ he said,” according to Heath’s reporting.

“A jump for soy by anything near 2 million hectares could be the largest since a 1.2 million year-on-year increase in 2012, 1.4 million in 2008 or even 1.9 million hectares in 2003,” Heath reported.

Braun reported that the expected slowest soy planting growth in Brazil in a decade “is logical, as the largest annual soy area increases in Brazil came during periods of lower global stocks and stocks-to-use, and vice versa.”

“According to Brazilian statistics agency Conab, yearly increases in soy plantings within the last four seasons range from 4.4% to 7%, though they spanned 2% to 3.7% between 2015-16 and 2019-20, when prices were low and supplies were high,” Braun reported.

Slower soy planting growth in Brazil is unlikely to prevent global stocks from swelling, however, as the “USDA sees global soybean stocks hitting all-time highs in 2024-25, almost 22 million metric tons more than in the prior year, and stocks-to-use are pegged barely shy of 2018-19’s record,” Braun reported.

“Brazil will play a large role in generating the surplus of beans as USDA projects a soy crop 16 million tons (10%) larger than in the prior season, with area rising 3.3%, though global soybean consumption is set to rise just 5% on the year,” Braun reported. “Brazilian farmers will start sowing soybeans for the 2024-25 harvest next month.”

Read also

AmSpec – Partner of BLACK SEA GRAIN.KYIV-2026

Black Sea & Danube Rapeseed Market at a Turning Point: Weather Risks, Supply ...

Indonesia to import 1 thsd tons of US rice despite self-sufficiency policy

China returns rapeseed oil from Kazakhstan over GM

Nigeria advances toward full membership in council of palm oil producing countries

Write to us

Our manager will contact you soon