Ag production value, volume soar to historic heights: ABARES

Australia’s farmers are on track to smash production value and volume records in 2021-22 on the back of exceptional seasonal conditions and a surge in world commodity prices.

Despite recent flood and rain damage in the eastern states, the ABARES ‘Agricultural Commodities: December Quarter’ is forecasting a history-making agricultural gross production value of $78 billion – $5.4 billion more than predicted just a few months ago.

The value of agricultural exports is forecast to hit a record $61 billion.

Production is expected to increase year-on-year for every major livestock commodity and almost every major crop commodity – with farmers forecast to produce the largest volume ever.

ABARES executive director Dr Jared Greenville said Australia was enjoying an extraordinary combination of favourable conditions and 30-year price highs.

“It would be the first time in at least half a century that production will increase for so many products at the same time,” Dr Greenville said.

“And if these forecasts are realised, 2021–22 will see the largest total volume of agricultural commodities Australia has ever produced.

“Prices are also at multi-year highs for many agricultural commodities.

“Higher export volumes and higher prices are forecast for almost every major export commodity, with the total value of agricultural exports being revised up $6.5 billion to $61 billion, also an all-time high.

“This uplift in Australian agricultural production value and volume is unprecedented and the result of exceptional growing conditions here and poor seasons being experienced by key overseas competitors.

“There is uncertainty how long prices will remain at these levels – and supply chain disruptions, higher fertiliser prices and heavy rainfall domestically will continue to be watch points.

“This forecast accounts for the unfortunately timed substantial rainfall and localised flooding in east coast growing regions during November.

“This will delay harvests and result in some crop losses, but this is unlikely to reduce national harvest tonnage significantly.

“The larger impact will be on grain quality, with a higher than usual proportion of the crop being lower-value feed-grade wheat.”

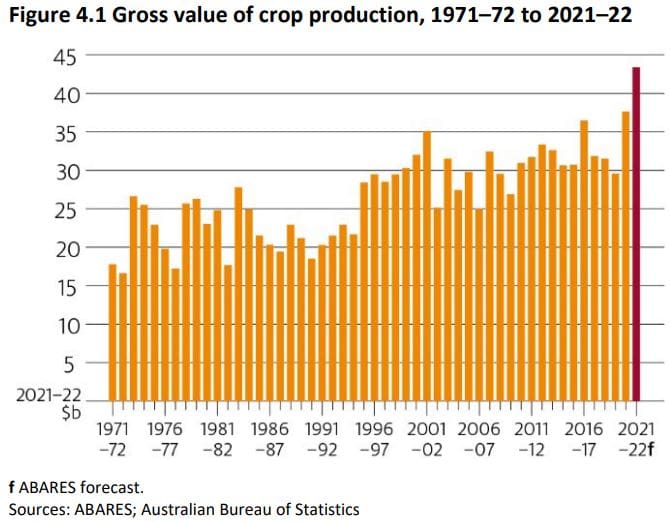

The gross value of crop production is forecast to reach a record $43 billion in 2021–22, driven by record winter crop production and high world grain and oilseed prices.

Favourable seasonal conditions across all winter cropping regions, particularly in New South Wales and Western Australia (the two biggest winter crop–producing states) are forecast to result in above average to significantly above average yields.

A favourable outlook for increased summer crop production is also contributing to the forecast record.

The world wheat indicator price is forecast to average US$330 a tonne in 2021–22, an increase of 23 per cent from the previous year.

The Australian Premium White (APW) indicator price is forecast to average A$400 a tonne.

Prolonged poor seasonal conditions in Canada, the United States and the Russian Federation has meant that world supply of hard, high-protein milling wheat is significantly lower in 2021–22.

World demand for barley is expected to outpace supply, leading to lower stocks and higher prices.

The world indicator price for barley is forecast to increase by 13pc to US$254 per tonne in 2021–22.

High world barley prices are being supported by demand from China.

Global demand for oilseeds has surged along with world oilseed prices. At the same time, world canola supply has contracted sharply, with production forecast to decrease by 7pc to 68 million tonnes in 2021– 22.

The fall in supply is driven by drought conditions affecting Canada (the world’s biggest canola exporter), where production is expected to decrease by 33pc to 13 million tonnes in 2021–22.

Total winter crop production is forecast to reach a record of just over 58 million tonnes in 2021–22.

If forecast production and prices are realised, this will be Australia’s most valuable winter crop ever at over $22 billion.

Favourable seasonal conditions in Queensland, New South Wales and Western Australia are expected to result in well above average yields.

Conditions in Victoria and South Australia have not been quite as good.

Western Australian production is forecast to reach a record high, Queensland and New South Wales production the second highest on record, Victoria the third highest and South Australia the fifth highest winter crop on record.

Australian wheat production is forecast to reach a new record in 2021–22 of around 34.4 million tonnes, which is 3pc higher than the previous record set in 2020–21.

Australian barley production is forecast to increase marginally to 13.3 million tonnes.

Canola production is forecast to reach a new record of 5.7 million tonnes reflecting both an increase in the area sown to canola and high yields particularly in New South Wales and Western Australia.

Australian summer crop production is forecast to increase by 43pc to 4.8 million tonnes reflecting a 32pc increase in the area sown and above-average yields.

Above-average spring rainfall has further replenished water availability for irrigated crops, and the moisture profile for dry area crops is well above average.

The outlook for summer rainfall is also positive.

In New South Wales, record high November rainfall is likely to have damaged some early sown summer crops and may hamper the completion of planting programs if paddocks remain too wet to access.

The delay in harvesting winter crops may also limit the area available to plant summer crops.

Australian sorghum production is forecast to increase by 31pc to 2 million tonnes in 2021–22 reflecting both an increase in the area planted and above-average yields.

Australian cotton production is forecast to reach nearly 1.1 million tonnes of lint (or 4.8 million bales) in 2021–22, an increase of 79pc from 2020–21.

A La Niña event over 2020–21 and a negative Indian Ocean Dipole during the winter months of 2021 have resulted in above average rainfall across much of the cotton-growing regions in the eastern states.

High international cotton prices and water availability is estimated to have resulted in 394,000 hectares of irrigated cotton being planted.

For dryland cotton, the Australian Bureau of Meteorology expects above-average summer rainfall.

However, the promising climate outlook is not all good news. Localised flooding in major production areas of New South Wales during November has prompted growers to replant substantial areas.

Australian cotton growers are expected to benefit from high international prices and favourable growing conditions in 2021–22.

Global demand for cotton is forecast to outpace global production leading to significantly higher prices and a draw down in global stocks.

The recent shift towards easing COVID-related restrictions and positive economic growth have improved incomes and lifted consumer confidence, resulting in higher demand for cotton apparel.

Australian sugar production is forecast to increase marginally to just under 4.4 million tonnes in 2021–22.

The gross value of Australian sugar production is forecast to increase by 13pc in 2021–22 to around $1.5 billion.

This increase will be driven by higher international prices which are forecast to reach US 20c/lb for 2021-22 up from 16.6c/lb in 2020-21.

Prices are expected to remain elevated due to tightening global supply conditions, as production in Brazil (the largest sugar producing nation) has been hampered by drought and frost throughout the year.

Read also

Oilseed Season 2025/26: Déjà Vu or New Chapter?

Nigeria, Brazil sign $1 billion deal to boost agriculture, energy

Corn exports from Ukraine in MY 2025/26 will increase by 3 mln tons

Feed wheat supplies are disappearing from the Black Sea markets, demand prices hav...

China’s feed production rises, soybean meal consumption falls

Write to us

Our manager will contact you soon