Will we have enough wheat in 2025?

Chicago, Kansas, and Minneapolis wheat futures enjoyed a near $1 price rally during the month of September.

Support for wheat prices in September stemmed from strong global demand, weather imperfections around the world, continued conflict in the Black Sea Region, and fund traders exiting (buying back) a large portion of their massive net short positions in order to show profits on the books for third quarter.

The first two weeks of October has brought about a modest price sell off for wheat futures, linked to better chances of rains in the southern U.S. Plains, and technical selling.

Looking at wheat prices for the coming weeks, the potential for moderate price action seems likely. Supply and demand fundamentals are relatively balanced, with prices seeming to be stabilizing until a fresh piece of fundamental news unfolds.

Global demand for wheat remains strong. According to the most recent USDA WASDE report, global demand for wheat is pegged at a whopping 802.54 million metric tons for the 2024-25 crop year. Yet, global production for that same time frame is projected to be at 794.08 MMT. You read that right, we will not grow enough wheat in the world to meet global demand. This news is supportive to prices.

But if this news is supportive to prices, why is wheat not rallying higher, especially if we are not going to grow enough wheat to meet demand? The simple answer: because there is a cushion of “carry-in supply” from the previous crop year.

This cushion of “carry-in supply” provides breathing room, however, makes traders keep their focus on global production. Every week traders will monitor updates to global supply and weather events.

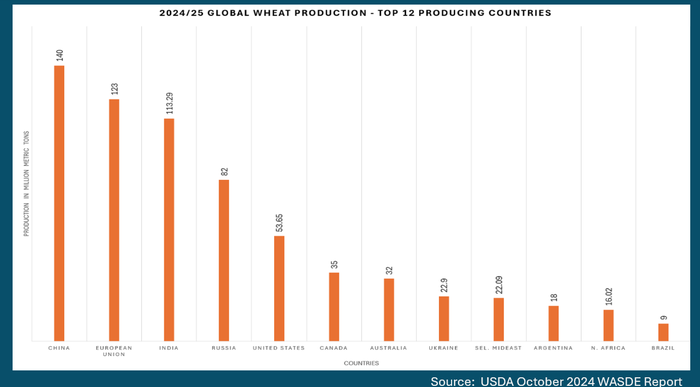

Global weather has not been perfect in 2024, as evident in slightly smaller crops in various places around the world. Below is a chart of the major global wheat producing countries.

China is the world’s largest producer of wheat growing 140 mmt. According to the most recent USDA report, China will consume 151 mmt of wheat, leaving the difference in demand needing to be imported. The European Union grows 123 mmt of wheat, and consumes 108.75 mmt, leaving room for the surplus to be exported. India is the third largest grower of wheat, with production pegged at 113.29, with domestic consumption using nearly all of it, at 112.29 mmt. Russia is the fourth largest grower of wheat, with production pegged at 82 mmt, and use 38.75 mmt, leaving a bountiful amount for export.

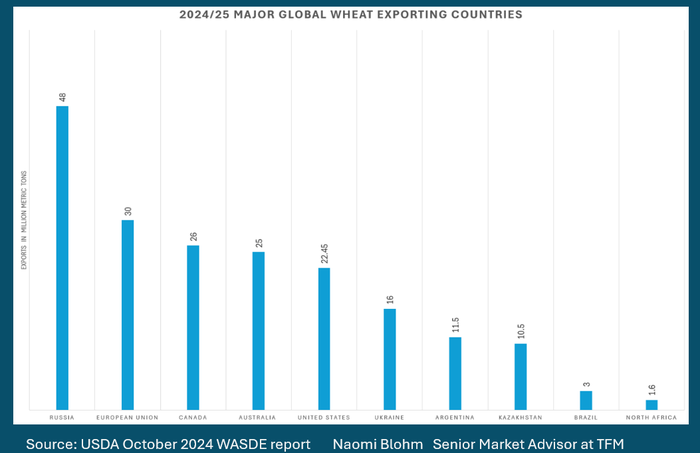

Speaking of exports, let’s take a look at which countries are the major wheat exporters to the world.

There are two main points I’d like to draw your attention to:

-

First: eight countries offer wheat to export to the world, with production based in both hemispheres. This supports the idea that wheat is likely available year-round.

-

Second: the countries that supply most of the global wheat exports are the countries to focus on for weather watching. If Russia, the European Union, Canada, Australia, the United States, Ukraine, or Argentina face any additional weather issues in the coming year, that means less production. And potentially less wheat available for export to the world. That would be supportive of a price rally.

Remember, the world is consuming more wheat than it is growing. Demand is strong, and the supply is up to Mother Nature.

With strong demand for wheat already exceeding global production, there is no room for weather hiccups as it pertains to global wheat production and supply. Trade will be sensitive to potential weather issues and continued geo-political concerns around the world. Wheat is a market that might have significant reasons to rally in 2025.

For almost 30 years of expertise in the agri markets, UkrAgroConsult has accumulated an extensive database, which became the basis of the platform AgriSupp.

It is a multi-functional online platform with market intelligence for grains and oilseeds that enables to get access to daily operational information on the Black Sea & Danube markets, analytical reports, historical data.

You are welcome to get a 7-day free demo access!!!

Read also

Abbey Commodities – General Partner of BLACK SEA GRAIN.KYIV-2026

Black Sea & Danube Barley Market at a Turning Point: Demand Pressure and Regi...

US Supreme Court rules Trump’s emergency duties illegal

Mercosur: Protective measures for European agriculture

US makes concessions on pulses in new trade deal with India

Write to us

Our manager will contact you soon