Why Are Pakistan’s Rice Exporters Worried?

Pakistan reported record rice exports of $3.88 billion in FY24, a 78% increase over the previous year. However, the industry is not celebrating because it has been hit with multiple challenges all at once adding to the existing volatility in the market.

The restrictions were imposed due to a rise in domestic inflation in India ahead of an election year. However, the ruling party had less than impressive results in general elections and faces challenging state assembly polls later this year in Haryana and Maharashtra, both states with strong farm lobbies.

India has been out of the market for a year so they have to clear their window and they have always been better at export pricing. Their return to the market will result will a significant impact on both the local and international prices of rice,” stated Amit Kumar, a rice trader from Karachi talking to ProPakistani

He added that if India issues the notification in the next couple of weeks, our local markets will adjust now and exporters might still achieve a competitive position but if the announcement comes near October or November, it will be far worse since we will already have significant stocks.

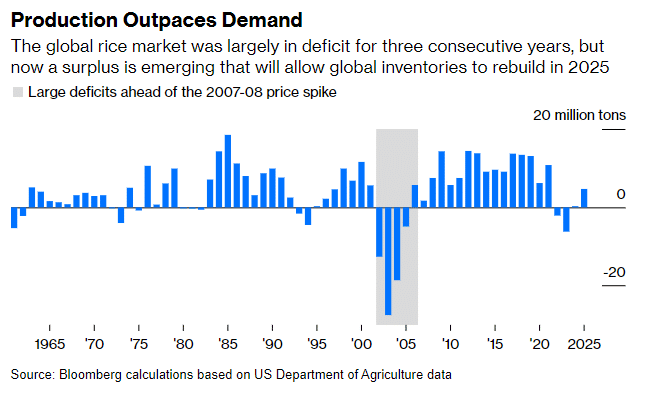

But that’s only the beginning. The onset of the La Nina weather system is also expected to recover rice production in the larger Asia Pacific region i.e. Indonesia, the Philipines, Vietnam, Australia and of course, India. This will end the three-year price scare in international rice markets that started with wars, protectionism, and panic buying leading to record-high prices in the last 15 years.

As a result, Bloomberg forecasts global rice production to reach a record high of 528.2 million tons in 2024-25 which would exceed the estimated consumption of 523.5 million tons building the inventories after years of declines.

At the same time, exporters are facing growing rejection risks from the EU, UK, and US due to violations of maximum residue limits (MRLs) of pesticides and the presence of mycotoxins (toxins produced by moulds and fungus) in shipments. According to recent media reports citing Luxembourg-based Eurofins Scientific SE, Pakistan’s rice shipments have faced 26 alerts so far for pesticide residues this year against 44 in 2023, 9 in 2022, and 6 in 2021. In the case of mycotoxins, there were 10 alerts in 2023 and two so far this year compared with 42 in 2022.

India on the other hand faced 15 alerts so far this year against 46 in 2023 while for mycotoxins, two alerts were issued this year compared with two for the whole of 2023.

Pesticide residues can come from not just field applications at farms but also excessive fumigation practices of containers. Critical residues in Pakisani shipments included chlorpyrifos-ethyl, hexaconazole, neonicotinoids, acetamiprid, imidacloprid, and thiamethoxam. This is a serious concern for rice exporters and the country already struggling to raise exports and bring foreign investments.

In March 2024, the Indian state of Punjab banned ten agrochemicals including Chlorpyrifos, Thiamethoxam and Imidacloprid following rising concerns about higher pesticide residues than MRLs. In Pakistan, the majority of farmers lack awareness regarding legal limits for the use of pesticides for export purposes, what agrochemicals are allowed for which crops and the need for sufficient time intervals between pesticide application and harvesting but the problems are not just limited there.

Department of Plant Protection, the entity responsible for among other things, inspections of food and agriculture export shipments, is reportedly severely understaffed. Following recent layoffs, DPP only has 16 regular staff remaining for inspections at 34 ports while being without a technical director since 1998. The capacity issues and lack of technical expertise could not have surfaced at the worst possible time for an industry facing a growing risk of rejections and bans.

Kumar said that the industry association has been urging the government to ensure inspection locally because when the violations are reported abroad, it results in far more damage to exporters and the country both financially and in terms of brand image.

To add to the troubles, the government has recently proposed to shift the industry to a hybrid tax regime with a standard taxation of 29 percent on taxable profit and NTR plus 10 percent Super Tax with a minimum of one percent paid. Industry stakeholders are projecting a drastic drop in exports if the governments stick with the proposed policy changes.

Skyrocketing costs of production at farms and processing stage have already shattered the leftover competitiveness of Pakistan in export markets so the government should have approached these policies carefully.

Government needs to bring together the industry stakeholders, farmers, and exporters to chart a course through these turbulent waters. The rice sector, once a golden grain in Pakistan’s export basket, now faces a perfect storm of challenges from the looming return of Indian competition to climate shifts, from pesticide problems to tax troubles.

This is exactly what happens when instead of building our strengths in a volatile market, we leave our crucial exports at the mercy of market dynamics like India staying out of the market or other regions experiencing uncertain climates. We need bold action, and we need it now. Modernize our farming practices, equip our inspection teams, and streamline our export processes.

Educate our farmers on global standards and empower our exporters with competitive policies. The rice fields of Pakistan have long been a source of pride and prosperity. Let’s not watch them wither on our watch when the future of our rural economy, the livelihoods of millions, and our standing in the global market hang in the balance.

Read also

Abbey Commodities – General Partner of BLACK SEA GRAIN.KYIV-2026

Export Logistics Reset 2026: Rail Tariffs, Capacity Pressure and New Trade Reality

ABIOVE has spoken out against the EU’s proposal to phase out soy-based biofu...

Jordan purchased 50 thsd tons of barley in tender

Brazil, Argentina ship 7 mil mt of soybeans to China for Feb-April

Write to us

Our manager will contact you soon