UK feed wheat vs imported maize – who’s the winner? Grain market daily

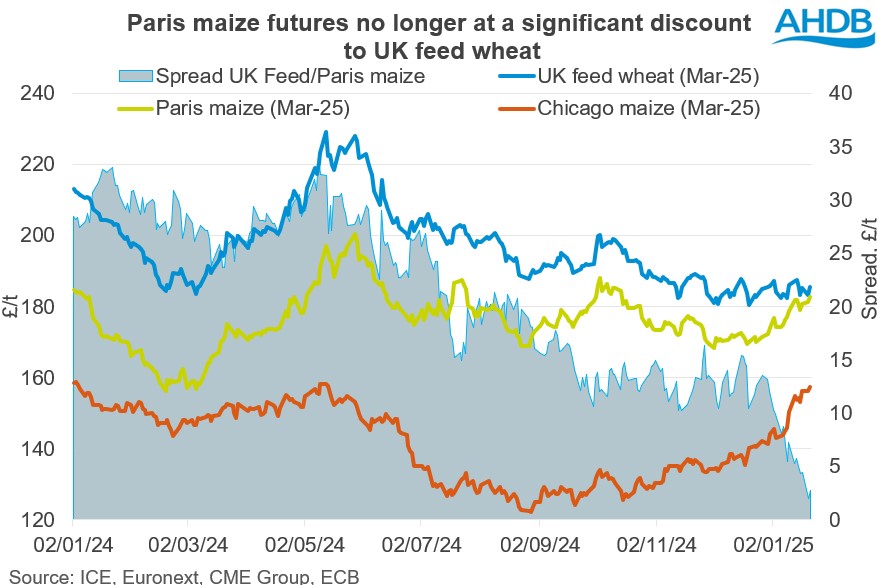

Currently, maize prices are a key driver in global grain markets due to fundamental factors, with prices on the rise since mid-October. As a result, the difference between UK feed wheat and Paris maize futures (Mar-25) is at a one and a half year low. Over the last twelve months, UK feed wheat futures (Mar-25) have reached a maximum of £34/t over Paris maize futures (Mar-25). On Monday, we saw the minimum spread in this period between UK feed wheat and Paris maize at £1.97/t.

Higher price differentials earlier in the season between UK feed wheat and imported maize stimulated a move to higher maize usage. In the latest GB animal feed data published last week, maize used for production in the current marketing year (Jul–Nov) is up 6.7% on the five-year average. Meanwhile, wheat used for GB feed production is down 4.2% on the five-year average for this period and is at the lowest level in 14 years for the first five months of the season.

Of course, it is worth noting that the decline in wheat usage from the average is not solely due to a shift to maize (and to an extent barley), but also an overall decline in GB feed production. Total feed production (incl. IPU’s) is down 2.4% on the five-year average.

The spread between UK feed wheat and Paris maize futures for March-25 is trending lower and we could see some support for domestic wheat moving forward. However, with many feed grain contracts secured ahead of time, it will likely be later on in the season that we see maize drop back in domestic rations.

As such, in our UK cereals supply and demand estimates released in November, we expected the amount of maize used for animal feed this season (Jul–Jun) to reach 1.44 Mt, up 7.2% on the year, and 8.3% on the five-year average. More up-to-date estimates are due to be published at the end of this month.

To summarise, the price relationship between imported maize and domestic wheat will be a key watchpoint over the coming months. As it stands, maize is becoming less competitive, and there are key bullish drivers in the global market for the grain. Therefore, unless we see a significant shift in global maize markets, it is likely we will see fewer imports as we head towards the end of the season and into the next.

For almost 30 years of expertise in the agri markets, UkrAgroConsult has accumulated an extensive database, which became the basis of the platform AgriSupp.

It is a multi-functional online platform with market intelligence for grains and oilseeds that enables to get access to daily operational information on the Black Sea & Danube markets, analytical reports, historical data.

You are welcome to get a 7-day free demo access!!!

Write to us

Our manager will contact you soon