The intensification of the covid pandemic in China will hit soybean demand the hardest

After the lifting of strict quarantine restrictions in China in the first 20 days of December, 248 million Chinese or 18% of the country’s population were infected, in particular, 37 million people were infected on December 20 alone, while until now the peak of infections in the country was 4 million cases/day. This indicates that the pandemic is gaining unprecedented proportions.

This spread of the virus was predictable, since three years of strict quarantines, which caused significant damage to the economy, prevented the population from gaining natural immunity, and vaccines developed in China are almost ineffective against new strains.

Due to the self-isolation of the population in large cities, the traffic of the metro and ground transport, as well as air transport, has almost halved. Industrial indices indicate a reduction in production, which will reach a minimum in January.

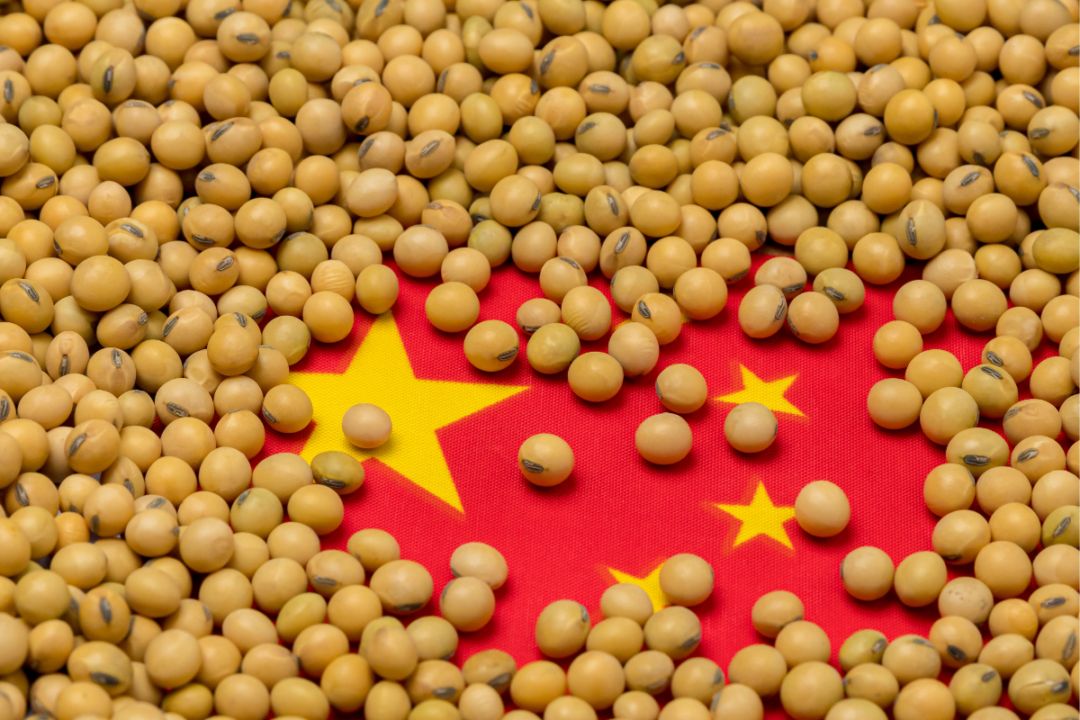

Until China’s economy begins to recover, energy prices will continue to fall, which will put pressure on food prices. Currently, traders are trying to assess how imports of soybeans, the world’s largest buyer of which is China, will decrease.

In MY 2021/22, China reduced soybean imports from 99.74 to 91.6 million tons compared to MY 2020/21, and experts expected imports to grow by 8.3% to 98 million tons in MY 2022/23 falling prices and a record harvest in Brazil, but the spread of the pandemic could significantly change the forecasts.

According to estimates by S&P Global Platts, in the event of a recession in China’s economy in 2023, the country may reduce demand for soybeans to 96-97 million tons, which, on the supply from Brazil at the level of 150-155 million tons in early 2023, may collapse soybean prices. Unless the drought in Argentina will reduce production and soften the situation.

China’s feed demand is forecast to increase in FY2022/23 due to the recovery of pig populations following recent ASF outbreaks, and increased poultry, livestock and aquaculture production. Almost 80% of imported soybeans in China are processed into animal feed. And the profitability of processing directly depends on the profitability of pig production, since most of the processed soybean meal is delivered to pig farms.

The soybean market is also pressured by the decrease in world prices for wheat and corn, which are used as an alternative to meal in the production of feed.

Read also

Ukraine is ready to help Syria prevent food crisis – Zelenskyy

Join with the EARLY RATE – 22 International Conference BLACK SEA GRAIN.EUROP...

Brazil sugar output decreased by 23% — Unica

Algeria imposes a complete ban on durum wheat imports in 2025

Weather in Brazil and Argentina remains favorable for the future harvest of soybea...

Write to us

Our manager will contact you soon