October WASDE: Corn and Wheat Stocks Expected to Decline

- October WASDE is scheduled for release at noon Friday EDT.

- Corn and wheat ending stocks are expected to drop from September.

- Disruptions in the Black Sea region and South America may accelerate U.S. sales.

- Corn and soybean futures offer traders some elevated premium to trade off.

We’re only a few days away from the United States Department of Agriculture’s World Agricultural Supply and Demand Estimates (WASDE) report for October, which is due Friday at 12:00 p.m. Eastern Daylight Time, and grain market volatility remains moderately elevated across the corn and soybean markets.

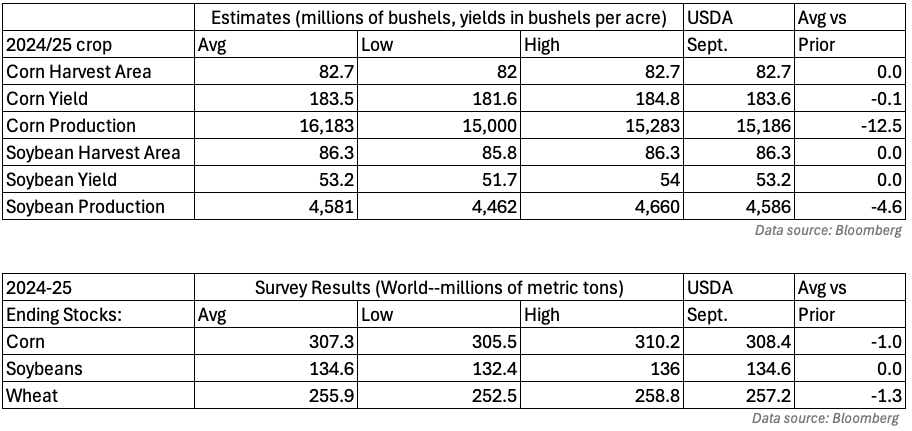

The WASDE is arguably the most impactful monthly report concerning price action in agricultural futures products, including corn, soybeans and wheat. Let’s explore recent price action, crop estimates and potential price movements in reaction to the WASDE numbers. Below are the survey results from Bloomberg for the United States and the world.

Corn futures (/ZCZ4) were down about 1% for the month as of today, with prices reversing earlier gains in three of the last four trading sessions. Despite the recent losses, prices remain near the highest levels traded since late June.

World corn ending stocks are expected to come in at 307.3 million metric tons (MTs), according to the average Bloomberg survey results. That would mark a 1 million MT reduction from the September WASDE.

U.S. ending stocks are expected to average 1.99 billion bushels, which would mark a decrease from the 2.06 billion bushels reported in the September WASDE. However, the high estimate is at 2.17 billion bushels. The U.S. corn harvest has been relatively easygoing because of dry weather across the corn belt, so we may see the number meet or even exceed the survey average from Bloomberg. If that occurs, we could see downward pressure on corn prices.

Looking at the technicals, we see corn prices trading at the 21-day exponential moving average (EMA)after pulling back from early October highs. Further degradation in the technical structure, which would be marked by a drop below the 21-day EMA could intensify some selling if we do see the WASDE print above estimates.

Soybean prices have struggled the most out of the three grain futures we’re discussing, with futures (/ZSX4) down nearly 4% for the month of October. The U.S. soybean harvest advanced against the 2019-2023 average, according to Monday’s crop progress report from the USDA. The soybean harvest rose to 47% complete across 18 states for the week ending Oct. 6, up from 26% the week before and 13% above the 34% 2019-2023 average. Brazil—a major soybean exporter—was also forecast to get some rain across its crop-growing regions, raising expectations for yields out of the country.

The September WASDE trimmed U.S. ending stocks for soybeans to 550 million bushels, which was down 10 million bushels from the month before but below the average trade estimate of 565 million bushels.

The survey average for U.S. ending stocks for the 2024/25 crop is expected at 546 million bushels, which would represent a 4 million bushel reduction from September. The high estimate is at 610 million bushels, while the low end is at 486 million bushels. Export sales have lagged, which leads me to believe we’ll come in at or above the high estimate. If so, we could see more soybean selling after the report. Given that the USDA is slow to react to changes in crop conditions in Brazil, the recent shift in the weather forecast for that region will likely remain unaccounted for.

The technical outlook for soybeans doesn’t bode well for a quick turnaround, assuming the numbers would be supportive. There is an area of former resistance that could turn support, but prices have already started to break into the range. Moreover, the price below the key EMAs shows sellers are in control for now.

Wheat prices (/ZWZ4) have outperformed corn and soybeans recently, with the grain on track for a third consecutive monthly gain and up nearly 2% since Oct. 1. We talked about the possibility for wheat to outperform last month. Crop issues outside the United States, mostly in South America and the Black Sea region—which includes Ukraine and Russia—have helped propel prices higher.

The issues overseas have supported U.S. exports, which could lead to a reduction in the WASDE’s ending stocks number. The Bloomberg average estimate puts the October world ending stocks for 2024/25 at 255.9 MT. That would mark a reduction of 1.3 MT from the September number. The range is also tighter, with the high estimate at 258.8 MT and the low estimate at 252.5 MT.

Technically, wheat prices look well-supported, trading above the nine-, 12- and 21-day EMAs. Prices also accelerated higher from a zone of congestion carved out from February to September. The drawback is the implied volatility in wheat futures doesn’t offer as much premium for trading vs. corn and soybeans.

For almost 30 years of expertise in the agri markets, UkrAgroConsult has accumulated an extensive database, which became the basis of the platform AgriSupp.

It is a multi-functional online platform with market intelligence for grains and oilseeds that enables to get access to daily operational information on the Black Sea & Danube markets, analytical reports, historical data.

You are welcome to get a 7-day free demo access!!!

Read also

Write to us

Our manager will contact you soon