Indonesia’s biofuel expansion poised to drive palm oil prices to record highs

Palm oil is set for a new bullish rally as Indonesia — the world’s largest producer — plans to expand its domestic biofuel program. The government intends to raise the biodiesel blend from 40% to 50% in the second half of 2026. Known as the B50 program, the move aims to reduce fuel imports and greenhouse gas emissions, but it may also significantly limit export volumes and tighten global supply.

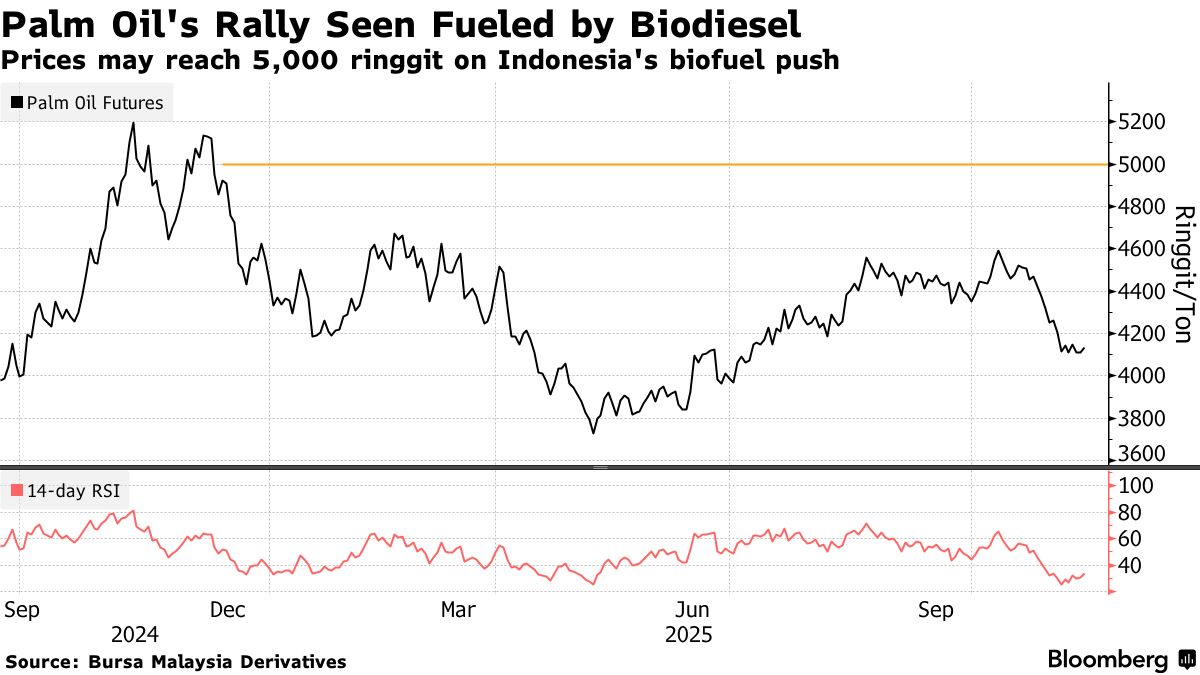

Amid stagnant production growth in major producing countries, experts warn that the initiative could push global prices higher, reshape the vegetable oil trade, and even fuel food inflation. Palm oil — used across food, cosmetics, and fuel industries — is currently trading around 4,145 ringgit ($999) per ton, about 6% lower year-to-date. However, if B50 is implemented, prices could climb to 5,000 ringgit per ton in the first half of 2026, according to Eddy Martono, chairman of the Indonesian Palm Oil Association (GAPKI).

Martono added that the policy may also lead to higher export levies, which would mainly affect smallholders. For global markets, it means tighter supplies as Indonesia — accounting for more than half of the world’s palm oil exports — prioritizes domestic biodiesel production. BMI commodities analyst Matthew Biggin noted that such a shift would force key importers like India and China to seek alternative sources of supply.

Indonesian authorities have completed laboratory tests for the B50 blend, while road tests are still pending. Gapki estimates that expanding the mandate could boost domestic palm oil consumption by 25% and cut exports from 31 million tons in 2025 to 26 million tons in 2026. Veteran trader Dorab Mistry of Godrej International expects this to push palm oil prices to 5,500 ringgit per ton — their highest level in three years.

The market also faces additional risks. A potential La Niña event may bring excessive rainfall, disrupting harvesting and output across the region. Other market drivers include U.S.–China agricultural trade developments, American biofuel policies that could limit soy oil exports, and fluctuations in global inventories of sunflower and rapeseed oils.

Analysts project that full implementation of B50 could begin as early as June 2026, increasing Indonesia’s biodiesel consumption to 15.6 million tons — about 18% of global palm oil use, up from 17% under the current B40 policy. “This will create a favorable environment for higher prices and further strengthen Indonesia’s influence in the global vegetable oil market,” said Jacquelyn Yow, associate director at CGS International Securities.

Read also

Abbey Commodities – General Partner of BLACK SEA GRAIN.KYIV-2026

Black Sea & Danube Barley Market at a Turning Point: Demand Pressure and Regi...

Rapeseed market focuses on new crop

China has not yet allowed the import of peas from Ukraine, but has increased suppl...

Canadian grain and oilseed exports to the EU could be suspended due to pesticide r...

Write to us

Our manager will contact you soon