Grain Traders See Record Profits Amid Food Crisis, Prompting Calls For Windfall Tax

According to The Guardian, the world’s top four grain traders (Archer-Daniels-Midland, Bunge, Cargill and Louis Dreyfus, known collectively as ABCD) have seen record or near-record profits or sales, and are forecasting demand to outstrip supply until at least 2024 – likely leading to even higher sales and profits over that period. The four companies control between 70% and 90% of global grain trade.

Cargill reported a 23% jump in revenues to a record $165bn for the year ended May 31, while Archer-Daniels-Midland recorded the highest profits in company history during the second quarter of this year. Bunge saw sales spike 17% in Q2, while Louis Dreyfus reported an 80% jump in profits for 2021 vs. the previous year on revenues of $1.62bn, a jump of nearly 25%.

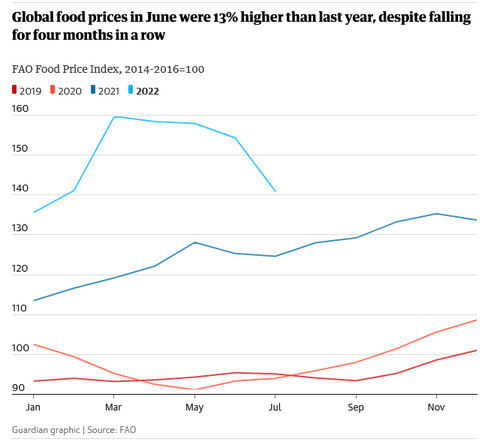

According to the UN Food and Agriculture Organization, food prices have spiked over 20% this year – while around 345 million people suffer from acute food insecurity according to the World Food Program, vs. 135 million people before the Covid-19 pandemic.

Olivier De Schutter, a co-chair of IPES-Food (the International Panel of Experts on Sustainable Food Systems) and UN special rapporteur on extreme poverty and human rights, said: “The fact that global commodity giants are making record profits at a time when hunger is rising is clearly unjust, and is a terrible indictment of our food systems. What’s even worse, these companies could have done more to prevent the hunger crisis in the first place.” -The Guardian

The rising price of grain has several causes – including the war in Ukraine, one of the largest producers of grain, sunflower oil, maize, and fertilizer. In addition, heatwaves in Europe, North America and India have affected production, while last year’s heatwaves in Canada hurt wheat crop yields. Ongoing high temperatures and wildfires this year will likely lead to further disruptions.

“Global grain markets are even more concentrated than energy markets and even less transparent, so there is a huge risk of profiteering” said De Schutter, who added that this year’s food price surge happened amid what was thought to be abundant global grain reserves. He says the ABCD companies weren’t transparent in revealing how much grain they hold, and there’s no way to force them to release stocks in a timely fashion.

“We need to be looking at the grain giants and asking what they could have done to avert the crisis, and what they could be doing now,” he said.

Moody’s analyst John Rogers says it’s not surprising that supply constraints and a jump in demand led to higher grain prices and, therefore, higher profits.

“I don’t think they are colluding for outsize profits,” he said, adding that other companies have been taking an increasing share of global grain markets.

“I don’t think they are acting immorally – they’re not intentionally driving up prices.”

Between the Ukraine war and heatwaves, grain producers stand to benefit greatly – as demand for their product surges amid constrained supplies.

“Ultimately, we need to break up the monopolies that have a stranglehold on the food chain. A handful of companies control global seed and fertiliser markets, animal genetics, the global grain trade, and food retail. They are making huge profits at the cost of farmers, consumers and the environment,” said De Schutter.

Read also

Abbey Commodities – General Partner of BLACK SEA GRAIN.KYIV-2026

Black Sea & Danube Barley Market at a Turning Point: Demand Pressure and Regi...

US Supreme Court rules Trump’s emergency duties illegal

Mercosur: Protective measures for European agriculture

US makes concessions on pulses in new trade deal with India

Write to us

Our manager will contact you soon