German cabinet sets 59% GHG quota by 2040, bans double-counting, adds SAF mandate

The “Second Law for the Further Development of the Greenhouse Gas Reduction Quota” is designed to implement the EU’s RED III directive and the ReFuelEU Aviation regulation into national law. It aims to provide investment security for producers of advanced biofuels and green hydrogen while cracking down on fraudulent imports that have plagued the market in recent years.

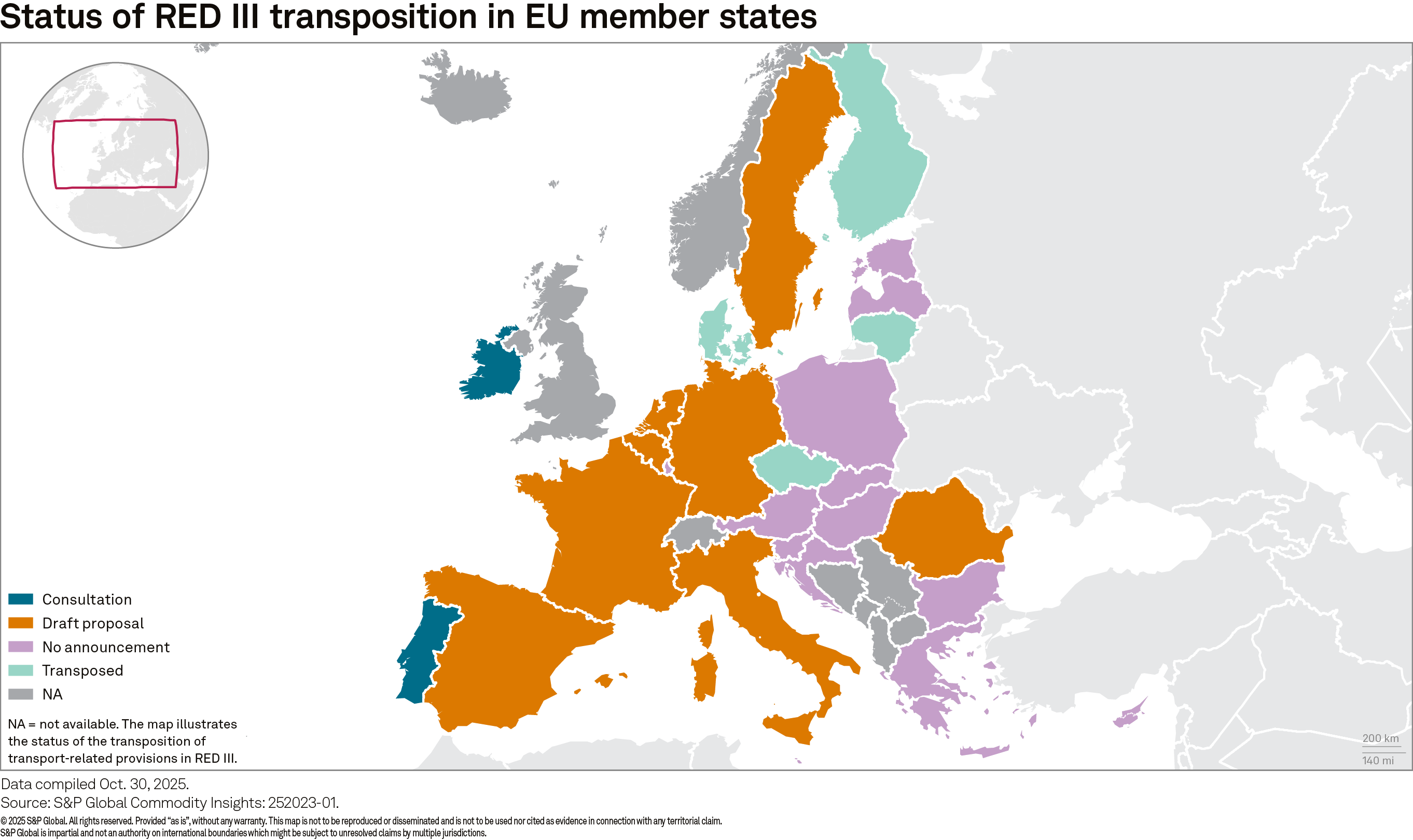

Market activity across the biofuels complex in recent weeks has been suppressed amid ongoing speculation about the expected timeline for implementing Germany’s RED III bill. The German Cabinet was initially scheduled to discuss the legislation in the first week of October, with the aim of transposing it ahead of Jan. 1, 2026.

Subsequently, however, the Cabinet postponed reaching a decision on the bill week to week, amid a reported lack of consensus among the key ministries involved in drafting the bill.

As a result, the available window for the bill to pass this year through both the lower and upper houses of Germany’s parliament, known respectively as the Bundestag and Bundesrat, has now become too tight. Consequently, the legislation will be passed into law in 2026, with most, but not all, policies within instructed to take effect retroactively from Jan. 1, 2026.

Ambitious quota trajectory

According to the draft text seen by S&P Global Energy, the headline GHG reduction obligation for fuel suppliers is expected to rise significantly from current levels. The law sets a fixed trajectory extending well beyond the previous 2030 horizon:

- 2026: 12%

- 2030: 25%

- 2035: 36%

- 2040: 59%

This effectively mandates a near-total decarbonization of the fuel mix by 2040, requiring a renewable energy share of approximately 62% in the transport sector.

End of double counting

The draft law confirms the elimination of the “double counting” mechanism for advanced biofuels. The government argues that market availability is now sufficient and that double-counting artificially inflates quota compliance without delivering real physical emissions reductions.

Additionally, the government confirmed that the double crediting of advanced biofuels will cease from Jan. 1, 2026, onwards despite the reality that the bill will not pass formally into law until later in the year.

The sub-quota for advanced biofuels, without the application of double counting, will also be raised:

- 2026: 2.0% (up from current mandates)

- 2030: 3.5%

- 2040: 9.0%

Crackdown on fraud and palm oil

In a direct response to recent scandals involving suspected fraudulent biofuel imports from Asia, the draft legislation introduces a “protection of integrity” clause. Crucially, renewable fuels will only be eligible for the quota if on-site inspections by competent authorities are permitted at the production facilities. This applies to both biofuels and Renewable Fuels of Non-Biological Origin (RFNBOs).

“Renewable fuels are only eligible for credit if on-site inspections by state inspectors are possible,” the draft states, signaling a move away from reliance solely on third-party voluntary certification schemes.

Furthermore, the bill codifies the complete exclusion of palm oil-based biofuels from the quota. This ban extends to residues and waste materials from palm oil production—such as palm oil mill effluent (POME)—closing loopholes that regulators feared were being used to cross-subsidize unsustainable palm production.

That said, the draft law further stipulates that the requirement for on-site audits will only become effective from 2027 onwards, reflecting the complexity of retroactively implementing certain policies into law.

Similarly, taking effect from 2027, is the complete exclusion of palm oil-based biofuels from the quota. This ban extends to residues and waste materials from palm oil production — such as palm oil mill effluent (POME) — closing loopholes that regulators feared were being used to cross-subsidize unsustainable palm production. Fuels derived from palm-oil-based residues and waste will remain eligible for quota in the 2026 commitment year, however.

New RFNBO, SAF mandates, maritime excluded

For the first time, Germany is introducing a dedicated sub-quota for RFNBOs (green hydrogen and synthetic fuels) across all transport modes, replacing the previous sector-specific targets. This quota begins at 0.1% in 2026, increasing to 1.2% by 2030 and reaching 8.0% by 2040.

The use of RFNBOs will be further incentivised by a multiplier, set at 3x from 2024 onwards, 2.5x from 2037, and gradually falling to 1x by 2040.

The legislation also formally integrates the ReFuelEU Aviation mandates into German law, requiring aviation fuel suppliers to blend a minimum share of Sustainable Aviation Fuel and synthetic kerosene. Penalties for non-compliance in the aviation sector are set at steep levels to ensure enforcement: EUR 4,700 per metric ton for missing SAF volumes and EUR 17,000/mt for missing synthetic aviation fuel volumes.

Conversely, the international shipping sector will not be obligated under the RED III mandate in Germany, in contrast to plans for neighbouring market Belgium and the Netherlands.

Market impact

The reforms are expected to increase compliance costs for fuel suppliers by approximately EUR 2.7 billion in 2030. However, the Federal Ministry for the Environment (BMUKN) argues this is necessary to drive “real” decarbonization and spur domestic investment in electrolyzers and advanced biofuel plants.

POME (palm oil mill effluent)—historically a second-tier feedstock—becomes the marginal source. Indonesian and Malaysian producers currently banking on double-counting benefits face an immediate viability crunch unless they can ramp volumes or negotiate offtake agreements. Conversely, POME processors with existing European supply relationships expect 20%–30% price appreciation as fuel suppliers scramble for any eligible advanced feedstock to backfill the multiplier loss.

One critical caveat: the law bans the crediting of residues from palm oil production starting in 2027, which creates a narrow window. POME demand is expected to surge in 2026–27, but regulatory headwinds are anticipated to emerge thereafter. Smart traders will front-load POME commitments before the 2027 restriction becomes tighter, increasing compliance.

Market participants tracking the legislation note the move is immediately bullish for advanced feedstock demand. “Single-counted, no more double-counting = bullish for POME because the plants will run more,” said one Singapore-based biofuel trader, referring to palm oil mill effluent. “The elimination of double-counting multipliers will force fuel suppliers to source substantially more actual physical biofuel volume starting mid-2026, tightening feedstock markets across Asia-Pacific.”

The draft law will now proceed to the Bundestag for parliamentary approval, with the legislative process expected to be completed in the first quarter of 2026.

Biodiesel premiums increased while outright prices fell in the Amsterdam-Rotterdam-Antwerp hub on Dec. 9, in line with declines in gasoil markets day over day.

Market participants from UK said This has pushed up on the bio[diesel] side, mainly HVO, which of course has also pushed up UCOME retrospectively. Another said, Not [seeing an impact in the feedstock market] yet …. but RTFC is up.

FAME 0 and RME outright barge prices showed minor falls day over day, falling $2.50/mt and just 50 cents, respectively, at $1,292/mt and $1,446/mt. Meanwhile, the UCOME FOB Amsterdam-Rotterdam-Antwerp outright showed the most significant fall across flat prices at $1,442/mt, down $11.50/mt.

“All up,” a Black-Sea based first-gen biodiesel trader said, pointing to veg oils, FAME 0 and RME. “RSO up by Eur15,” adding that there should be enough crop available next year to meet targets.

In premiums, the FAME 0 premium over ICE LSGO rose by $10/mt to $647/mt, while the RME premium was assessed at $12/mt higher at $801/mt. The UCOME FOB Amsterdam-Rotterdam-Antwerp premium over gasoil was assessed at $797/mt, up just $1/mt.

Platts, part of S&P Global Energy, assessed FOB Amsterdam-Rotterdam-Antwerp used cooking oil unchanged day over day at $1,213/mt.

Read also

Black Sea Export Strategies Within the Pressure of the Global Food Market

EU Crop Protection Rules Could Reshape Ukrainian Agriculture Profitability

Jordan purchased 50 thsd tons of barley at tender

Soybean prices in Ukraine continue to rise, but Chicago quotes have already stabil...

US intends to raise global import tariffs to 15% this week – Bessent

Write to us

Our manager will contact you soon