From wheat to soybeans: how competition for acreage is changing the Black Sea region

Grain Prices Surge in Black Sea and Danube Regions, Driven by Market Factors

This season, grain prices in the Danube and Black Sea regions have risen by 1.5 times. Meanwhile, on the Chicago Mercantile Exchange, wheat futures contracts have remained nearly unchanged over the past year, while corn futures have increased by 12-13%.

Analysts from UkrAgroConsult suggest that the price surge in Ukraine is due to domestic factors, including export demand, last year’s drought, and changes in logistics. For the first time in three years, grain prices this season are shaped by market dynamics rather than geopolitics.

Ukraine Resumes Traditional Export Pace

Ukraine is a key exporter of wheat from the Black Sea and Danube regions. This season, exports are returning to their traditional rhythm, with wheat primarily shipped in the first half of the season. In the second half, prices are supported by dwindling wheat stocks.

Ukrainian wheat has regained markets in Southeast Asia, with exports to Indonesia, Vietnam, Thailand, and Bangladesh. This was made possible by the stable operation of the maritime corridor. In Indonesia, for instance, Ukraine has displaced Bulgaria, which was a major exporter to the country last year.

Rising Prices Spur Wheat Acreage Expansion

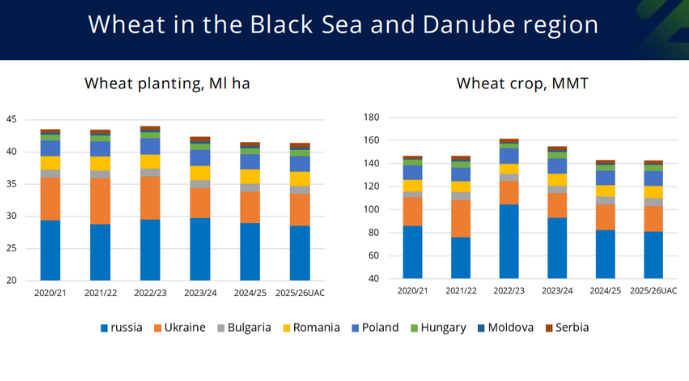

In Ukraine, higher grain prices have led to an expansion of winter wheat acreage. Other countries in the Black Sea and Danube regions are also increasing wheat planting areas, with the exception of Russia, which is expected to reduce sowings due to economic factors and market overregulation.

For the 2025 season, analysts forecast a wheat harvest in the Black Sea and Danube regions at last year’s level, approximately 143 million tons. According to Maksym Kharchenko, reduced wheat production in Russia could be offset by increased acreage and yields in European countries and Ukraine.

Wheat Acreage and Yields in the Black Sea and Danube Regions

Globally, the 2025/2026 season is expected to see a decline in wheat trade volumes. As a result, major wheat exporters are holding significant stocks by the end of the current season, adding downward pressure on prices at the start of the next season.

Next season, demand for wheat is expected to rise from Turkey and China, but this will not be sufficient to absorb the surplus supply on the market. Balancing the market will be challenging, though weather conditions could alter the situation. If spring brings difficulties for producing countries, wheat prices could rise.

Experts also note that winter grains emerged from this winter in good condition, particularly in the Black Sea region. A mild winter prevented winterkill, but a lack of precipitation could pose risks to spring vegetation.

Competition Between Grains and Oilseeds

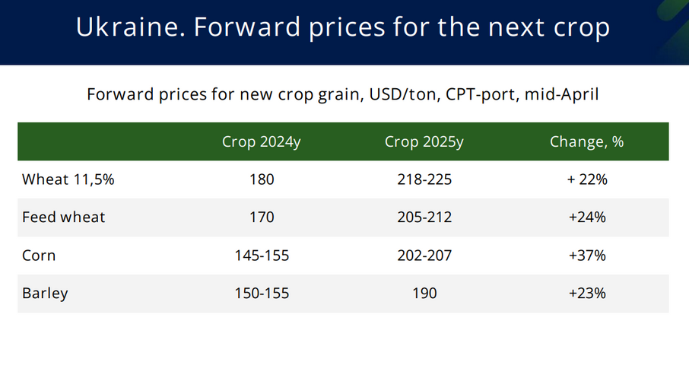

The cost of grain production has risen by 3-6%, while forward prices for wheat have increased by 25% and for corn by 37%.

Forward Prices for Ukraine’s Next Harvest

Due to these trends, corn acreage is expected to continue growing. Grains are showing better profitability, but oilseeds remain attractive. In the new season, competition for acreage between grains and oilseeds will be intense.

After record soybean plantings, analysts expect a decline in the next season, while corn acreage will continue to expand.

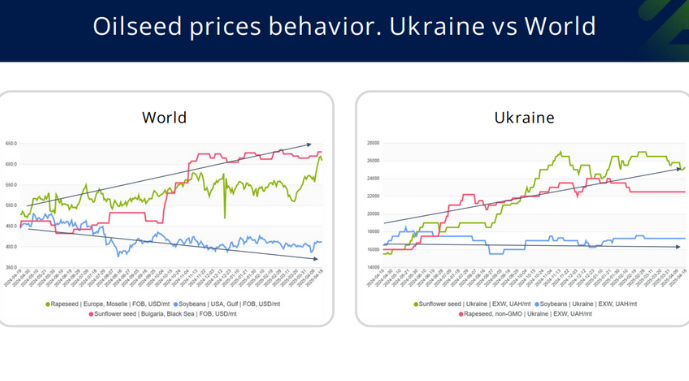

This season, global oilseed production hit a record high, driven by soybeans, though rapeseed and sunflower yields declined. This has impacted prices: soybean prices have been falling over the past year and are expected to decline further at the start of the new season, though less significantly than sunflower oil and rapeseed prices. The new harvest will exert additional pressure on prices. Meanwhile, sunflower prices are rising both globally and in Ukraine.

Oilseed Prices in Ukraine and Globally

Record acreage does not always translate to record harvests, as weather plays a decisive role. This season, record oilseed acreage did not yield a record harvest. While soybean production was high due to large planting areas, sunflower and rapeseed harvests declined.

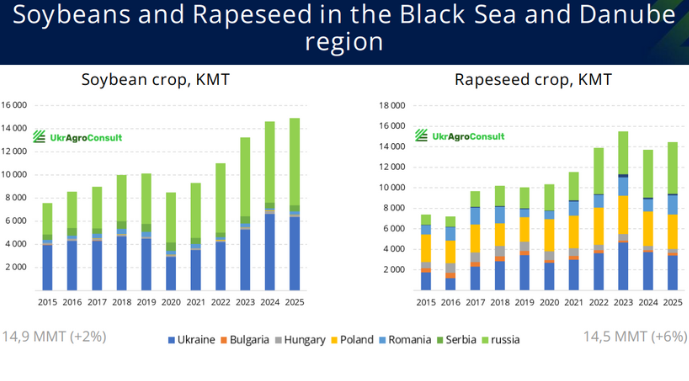

In the Black Sea and Danube regions, soybean production is expected to rise to 14.9 million tons this year, despite an overall reduction in acreage. Ukraine has reduced winter rapeseed acreage due to drought, while Bulgaria and Romania have shifted from corn to rapeseed. Rapeseed acreage will remain substantial, with production expected to reach 14.5 million tons. However, much depends on weather, as the analyst cautions.

Soybean and Rapeseed Yields in the Black Sea and Danube Regions

Sunflower typically delivers the highest yields in the Black Sea region. In the 2025/2026 season, Ukraine is expected to increase sunflower acreage.

“Overall, in the next season, we expect oilseed production in the Black Sea and Danube regions to rise to 67 million tons, potentially making this the second-highest season on record. For grains, production is projected at 225 million tons, but the new season will not be a record due to reduced grain harvests in Russia,” concludes Maksym Kharchenko.

EU’s Appetite for Ukrainian Corn Grows Amid Drought

Ukraine, Poland, and Romania are the main corn exporters to the EU from the Black Sea and Danube regions. While Poland and Romania focus on meeting internal European demand, Ukraine exports significantly more to the EU. Currently, EU corn imports are outpacing the past five seasons.

Ukraine remains the primary corn supplier to the EU, accounting for 57% of the market. However, competition from the U.S. has intensified, particularly in distant markets like Spain and Portugal.

China has barely purchased Ukrainian corn this season, but this was offset by Turkey, where corn exports doubled.

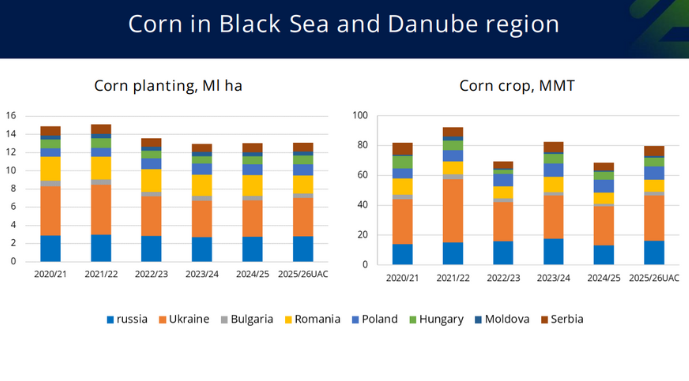

According to the expert, corn acreage in the Black Sea and Danube regions will decline overall. For instance, Romania and Bulgaria are planting less corn, considering it risky. In contrast, Ukraine expects an increase in corn production.

Corn Acreage and Yields in the Black Sea and Danube Regions

Impact of Global Trade Wars on Ukraine

Recent decisions by the administration of U.S. President Donald Trump are affecting global markets and agricultural trade flows. The situation changes weekly, but analysts believe Trump’s tariff wars could create opportunities for the Black Sea region. For example, continued trade tensions between the U.S. and Europe could boost Ukraine’s corn and soybean exports to the EU. A similar dynamic could enhance Ukraine’s presence in the Chinese market.

In the 2025/2026 season, countries will prioritize protecting their domestic economies and ensuring food security while addressing climate change. Agricultural producers hope last year’s drought will not become an annual occurrence, though they are gradually adapting to climate shifts.

Read also

Black Sea Export Strategies Within the Pressure of the Global Food Market

Black Sea Wheat Market Faces New Competition and Price Pressure Ahead of Harvest

Ukraine maintains leadership in sunflower oil supplies to the EU

Іugarcane crops in Bangladesh have halved in the last 10 years

Egypt to develop biodiesel production from used cooking oil

Write to us

Our manager will contact you soon