FAO Food Price Index continued to drop in December, however, it rose substantially on a yearly basis

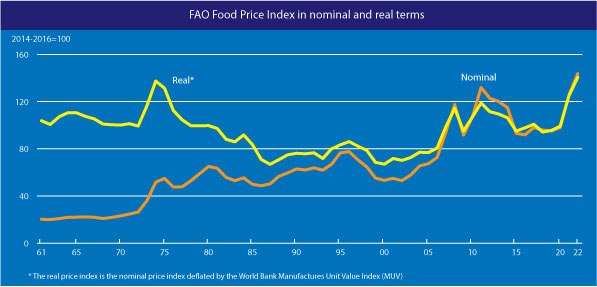

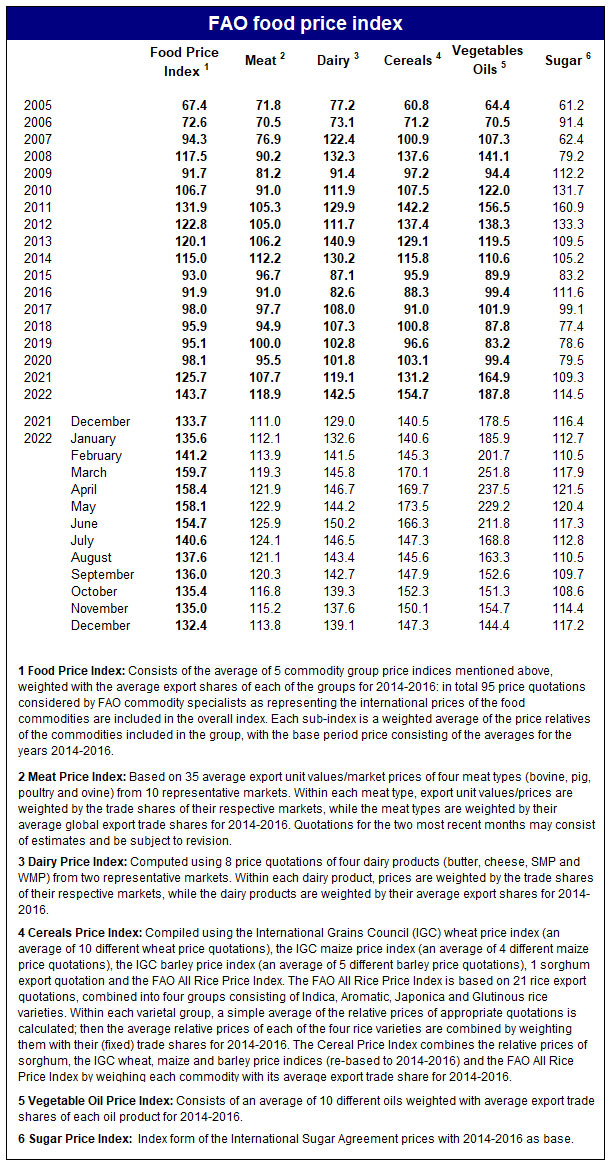

The FAO Food Price Index* (FFPI) averaged 132.4 points in December 2022, down 2.6 points (1.9 percent) from November, marking the ninth consecutive monthly decline and standing 1.3 points (1.0 percent) below its value a year ago. The decline in the index in December was driven by a steep drop in the international prices of vegetable oils, together with some declines in cereal and meat prices, but partially counterbalanced by moderate increases in those of sugar and dairy. For 2022 as a whole, however, the FFPI averaged 143.7 points, up from 2021 by as much as 18 points, or 14.3 percent.

» The FAO Cereal Price Index averaged 147.3 points in December, down 2.9 points (1.9 percent) from November, but still 6.8 points (4.8 percent) above its December 2021 value. Wheat export prices fell in December, as ongoing harvests in the southern hemisphere boosted supplies and competition among exporters remained strong. World maize prices also eased month-on-month, mostly driven by strong competition from Brazil, although concerns over dryness in Argentina provided some support. Influenced by spillover from maize and wheat markets, world prices of both sorghum and barley also declined. By contrast, purchases by Asian buyers and currency appreciations against the United States dollar in some exporting countries kept international rice prices on the rise in December. For 2022 as a whole, the FAO Cereal Price Index reached a new record high of 154.7 points, up 23.5 points (17.9 percent) from 2021, surpassing by 12.5 points (8.8 percent) the previous annual average record registered in 2011. World prices of maize and wheat reached new record highs in 2022, averaging, respectively, 24.8 and 15.6 percent higher than their 2021 averages, while rice export prices were on average 2.9 percent above their 2021 levels. The increase in the FAO Cereal Price Index in 2022 was due to a host of factors, including significant market disruptions, increased uncertainties, higher energy and input costs, adverse weather in a few key suppliers, and continued strond global food demand.

» The FAO Vegetable Oil Price Index averaged 144.4 points in December, down 10.3 points (6.7 percent) from November and hitting its lowest level since February 2021. The decrease in the index in December was driven by lower international quotations across palm, soy, rapeseed and sunflowerseed oils. World palm oil prices dropped by nearly 5 percent after a short-lived recovery in the previous month, chiefly underpinned by a sluggish global import demand, despite lower outputs in major palm oil producing countries due to excessive rainfalls. Meanwhile, world soyoil prices fell markedly, largely due to positive prospects of seasonally rising production in South America. As for rapeseed and sunflowerseed oils, international prices dropped on account, respectively, of ample global supplies and subdued import demand, particularly from the European Union. Lower crude mineral oil prices also exerted downward pressure on world vegetable oil quotations. For 2022 as a whole, the FAO Vegetable Oil Price Index averaged 187.8 points, up 22.9 points (13.9 percent) from 2021 and marking a new record annual high.

» The FAO Dairy Price Index averaged 139.1 points in December, up 1.5 points (1.1 percent) from November, registering an increase after five months of consecutive declines and surpassing by 10.1 points (7.9 percent) its value a year ago. In December, international cheese prices rose, mainly reflecting a robust global import demand and somewhat tighter export availabilities amid high internal retail and services sector sales, especially in Western Europe. By contrast, international butter prices fell for the sixth consecutive month, underpinned by the continued sluggish global import demand and the availability of adequate domestic inventories to cover near-term needs. Meanwhile, international milk powder prices decreased slightly, as lower prices in Western Europe, driven mainly by sluggish demand for spot supplies, outweighed increases in quotations for supplies from Oceania, primarily reflecting active buying from Southeast Asia and currency movements. In 2022 as a whole, the FAO Dairy Price Index averaged 142.5 points, up 23.3 points (19.6 percent) from 2021 and registering the highest annual average on record since 1990.

» The FAO Meat Price Index* averaged 113.8 points in December, down 1.4 points (1.2 percent) from November, marking the sixth consecutive monthly decline, but remained 2.8 points (2.5 percent) above its year-earlier level. The decrease in the index in December was driven by lower world prices of bovine and poultry meats, partially counterbalanced by higher pig and ovine meat prices. International prices of bovine meat fell, pressured by a higher supply of slaughter cattle in several large producing countries and lacklustre global demand for medium-term supplies. Meanwhile, poultry meat prices declined, as export availabilities were more than adequate to meet import demand for spot supplies, despite production setbacks due to intensified avian influenza outbreaks. By contrast, world pig meat prices increased, underpinned by solid, pre-Christmas internal demand, especially in Europe, whereas ovine meat prices rose due to currency movements. In 2022 as a whole, the FAO Meat Price Index averaged 118.9 points, up 11.2 points (10.4 percent) from 2021, marking the highest annual average registered since 1990.

» The FAO Sugar Price Index averaged 117.2 points in December, up 2.8 points (2.4 percent) from November, registering the second consecutive monthly increase and reaching its highest level in the past six months. The December increase in international sugar price quotations was mostly related to concerns over the impact of adverse weather conditions on crop yields in India, the world’s second largest sugar producer, and sugarcane crushing delays in Thailand and Australia. For 2022 as a whole, the FAO Sugar Price Index averaged 114.5 points, up 5.1 points (4.7 percent) from 2021 and reaching its highest annual average since 2012.

* Unlike for other commodity groups, most prices utilized in the calculation of the FAO Meat Price Index are not available when the FAO Food Price Index is computed and published; therefore, the value of the Meat Price Index for the most recent months is derived from a mixture of projected and observed prices. This can, at times, require significant revisions in the final value of the FAO Meat Price Index which could in turn influence the value of the FAO Food Price Index.

|

|

|

Download full dataset: Excel |

Read also

Black Sea & Danube region: How agri business can generate money in 2026

Canada’s total wheat production nears 40 mln tons

Ukrainian disk harrow Velly will operate in South America

Malaysian palm oil exports are declining, while Indonesian palm oil exports are gr...

Vietnam eases access to GM feed materials to curb rising feed costs

Write to us

Our manager will contact you soon