China’s Slow Soybean Purchases Pressure Corn Markets

Corn fell again last week while wheat traded sideways. China continued buying US wheat and soybeans, while Russian wheat production was revised higher. The outlook remains more bearish than bullish due to abundant global supplies, with limited support from the slow Ukrainian corn harvest and China’s uncertain soybean purchases, which may not meet the 12 million tonne target by year-end.

The focus last week was exports to China, as the market is debating whether they will happen or not. Trump and his administration have stated that China will buy 12 million tonnes of soybeans before the end of the year, but official data shows 1.8 million tonnes bought as of last week after the latest publication. This means it will be increasingly difficult that China will buy all the committed volume.

The positive tone came on the wheat side, with fresh exports to China of around 132,000 tonnes announced last week — the second purchase of wheat.

Our view remains unchanged, with more downside than upside risk given ample supplies in all key producing countries in both corn and wheat. The only supportive factors are the slow pace of the Ukrainian corn harvest and the speed of China’s soybean buying – although there are many question marks over the latter.

Last week started strong for all grains in all geographies after the selloff of the previous Friday. However, a selloff begun on Wednesday and carried on through the rest of the week, dragged lower by soybeans as China’s purchases of US grains continue at a slow speed.

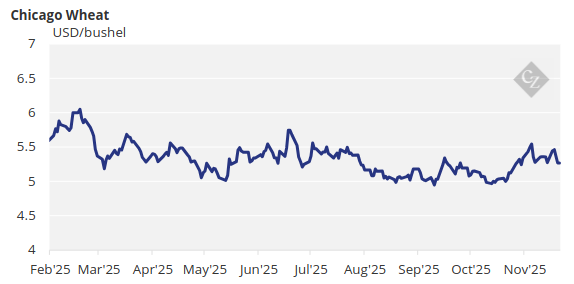

Corn closed the week negative both in Chicago and Euronext, but wheat was able to close the week unchanged in Chicago and with small gains in Euronext.

The USDA released fresh but delayed data thanks to the government reopening, and the reality is that crop progress was not much different from what the market was expecting.

Harvesting of US corn is 91% completed versus 98% last year and the five-year average of 94%. Harvesting in France is 99% complete vs. 80% last year and just ahead of the five-year average of 94%. Corn condition was 59% good or excellent, unchanged week on week but a deterioration on 75% last year.

Corn harvesting in Ukraine is 71% complete – behind last year’s 94%. Harvesting in Russia is also behind at 65.6% compared with 92.3% last year. Corn planting in Argentina is 37.3% complete. Summer corn planting in Brazil is 52.6% complete – about on par with last year and the five-year average.

US wheat was able to close the week unchanged despite the negative week in corn, mostly thanks to fresh sales to China and despite strong crops everywhere.

A rumour that China had bought US wheat was later confirmed at a quantity of 132,000 tonnes, which gave the market some momentum.

On the negative side, Russian agency SovEcon revised its wheat production higher to 88.6 million tonnes from 87.8 million tonnes previously.

US winter wheat is about on track at 92% planted and condition is 45% good or excellent – slightly lower than last year. Winter wheat planting in France is 95% complete – ahead of both last week and the five-year average. Conditions are 98% good or excellent, unchanged week on week. Ukrainian and Russian winter wheat planting are both almost complete. Argentinian wheat is 20.3% harvested.

On the weather front, mild temperatures together with rains are expected in the US southern corn belt and the Great Plains, while freezing temperatures are expected in the northern parts.

Weather is expected to be rainy in most of Brazil’s Centre-South, while a heatwave is forecast in Argentina but accompanied by rains during the second part of the week.

Europe is expected to be rainy and cold but within seasonal averages after very cold temperatures last week. The Black Sea region is expected to be cold and rainy.

Author: Alberto Carmona

For almost 30 years of expertise in the agri markets, UkrAgroConsult has accumulated an extensive database, which became the basis of the platform AgriSupp.

It is a multi-functional online platform with market intelligence for grains and oilseeds that enables to get access to daily operational information on the Black Sea & Danube markets, analytical reports, historical data.

You are welcome to get a 7-day free demo access!!!

Read also

Abbey Commodities – General Partner of BLACK SEA GRAIN.KYIV-2026

Corn prices in Ukraine dropped to $212–213/t

Export Logistics Reset 2026: Rail Tariffs, Capacity Pressure and New Trade Reality

India’s palm oil imports rose 51% in January, reaching a four-month high

Morocco expects grain harvest to double following heavy winter rains

Write to us

Our manager will contact you soon