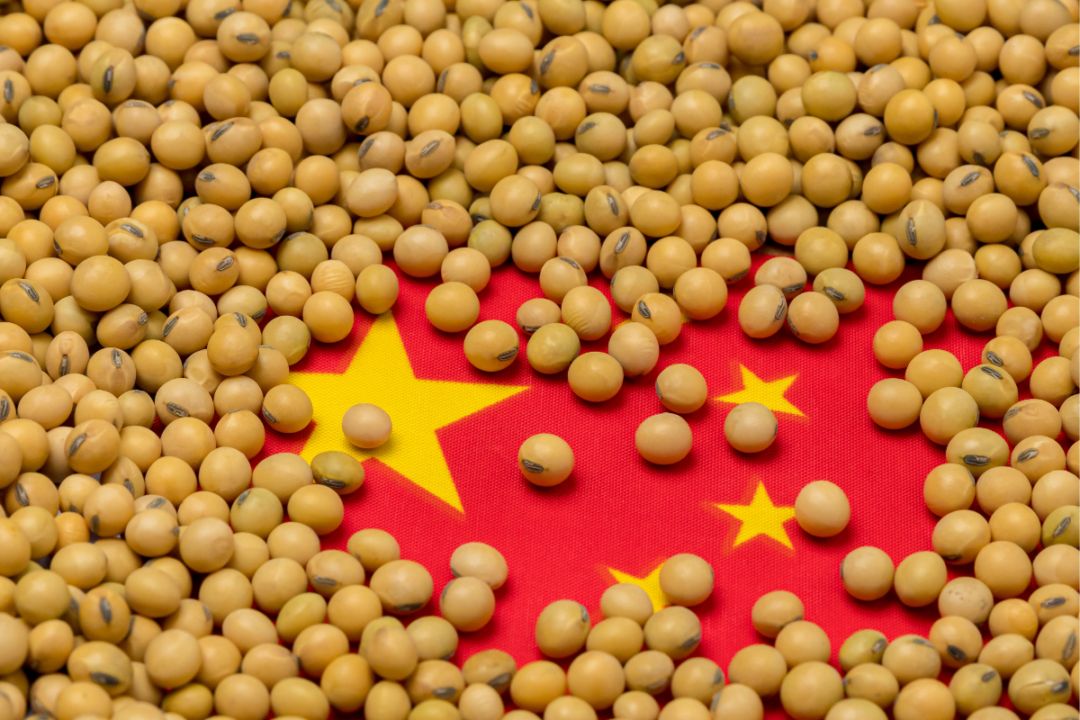

China poised for record July soybean imports on low prices

China is likely to import record volumes of soybeans in July, drawn by lower prices and the prospect of Donald Trump returning as president and reigniting trade tensions between Beijing and the US, which was once China’s top supplier of the oilseed.

The world’s biggest soybean importer has booked higher volumes in recent weeks, traders and analysts said.

“Chinese soybean importers are buying larger volumes as they are trying to protect themselves as much as they can from a possible increase in US tariffs if there is a trade war after US elections,” said Vitor Pistoia, an analyst at Rabobank in Sydney.

Trump administration tariffs on Chinese goods provoked retaliation from Beijing including a 25% duty on US beans, which forced oilseed processors to seek alternative South American cargoes, slashing US soybean exports to China to 16.6 million tonnes in 2018, from 32.9 million tonnes in 2017.

While the US and China signed a deal in January 2020 in which Beijing committed to buying more US agricultural products including soybeans, the US has ceded market share as ample supplies of cheaper Brazilian beans became entrenched in China.

Last year, Brazil accounted for 70% of China’s soybean imports, while the US share was 24%, even though US beans are no longer subject to additional duty.

Demand scenario

Chinese buyers have booked around 12 million-13 million tonnes of soybeans for July arrival, according to two Singapore-based traders and two analysts in China, compared with 9.73 million tonnes shipped in the same month a year ago.

China’s soybean imports hit a monthly all-time high of 12.02 million tonnes in May 2023.

“Just looking at the demand in China, purchases for July would have been 10 million tonnes if there was no fear of trade war,” said one of the traders, declining to be named because he was not authorised to speak to media.

Soybeans are crushed to make soymeal, a protein-rich ingredient for feeding animals, and soyoil, used in cooking.

China’s soybean crush margins are negative in the spot market but are likely to recover in the coming months with expectations of ample animal feed demand, traders said. For now, oilseed crushers in the processing hub of Rizhao are losing 198.37 yuan (RM128.66) per tonne.

Low prices are a key driver of China’s purchases, with benchmark Chicago soybean futures Sv1 dropping to their lowest level since 2020 on Monday on expectations of plentiful world supplies.

Global soybean production is expected to hit an all-time high of 422.26 million tonnes in 2024/25, up from 395.91 million tonnes produced in the current marketing year, according to US Department of Agriculture estimates.

The bulk of China’s buying is from Brazil.

“Brazilian beans are cheaper and the demand from Chinese buyers is strong,” said Rosa Wang, analyst at Shanghai-based agro-consultancy JCI.

Luiz Fernando Roque, an analyst at Safras & Mercado in Brazil, said a weaker Brazilian currency against the dollar incentivises soybean exports, and he did not see the prospect of Trump returning to office playing a factor for now in the Brazilian market.

Still, he said, “Trump’s victory increasingly seems imminent, and this brings risk to China, given what has already happened in his first term.”

Tags: China, Brazil, soybean, imports