Bunge Says Viterra Deal Conclusion May Be Delayed Into 2025

Bunge Global SA said its $8 billion acquisition of Glencore Plc-backed Viterra may be further delayed as the company waits for government approvals in key markets.

The transaction may now be closed as late as early 2025, Chief Executive Officer Greg Heckman said during an earnings call on Wednesday. The deal was initially expected to be completed earlier this year.

“We continue to engage with the relevant authorities as we work toward gaining the few remaining regulatory approvals,” Heckman said on the call. While the transaction has won a conditional nod from the European Union, it is still pending a greenlight by authorities including in Canada and China. Still, Heckman said he doesn’t expect “any issues that would materially and purely impact the economics of the deal.”

The agreement, which was announced more than a year ago, is expected to create a $25 billion behemoth capable of competing with the industry’s biggest players including Cargill Inc. and Archer-Daniels-Midland Co.

Bunge reported a decline in third-quarter profits as it navigates a scenario of lower crop prices around the globe.

Earnings per share excluding mark-to-market timing differences were $2.29 a share in the three months ended September, down 23% from a year earlier and still the lowest since 2019 for the period. That still exceeded the $2.14 average of analyst estimates.

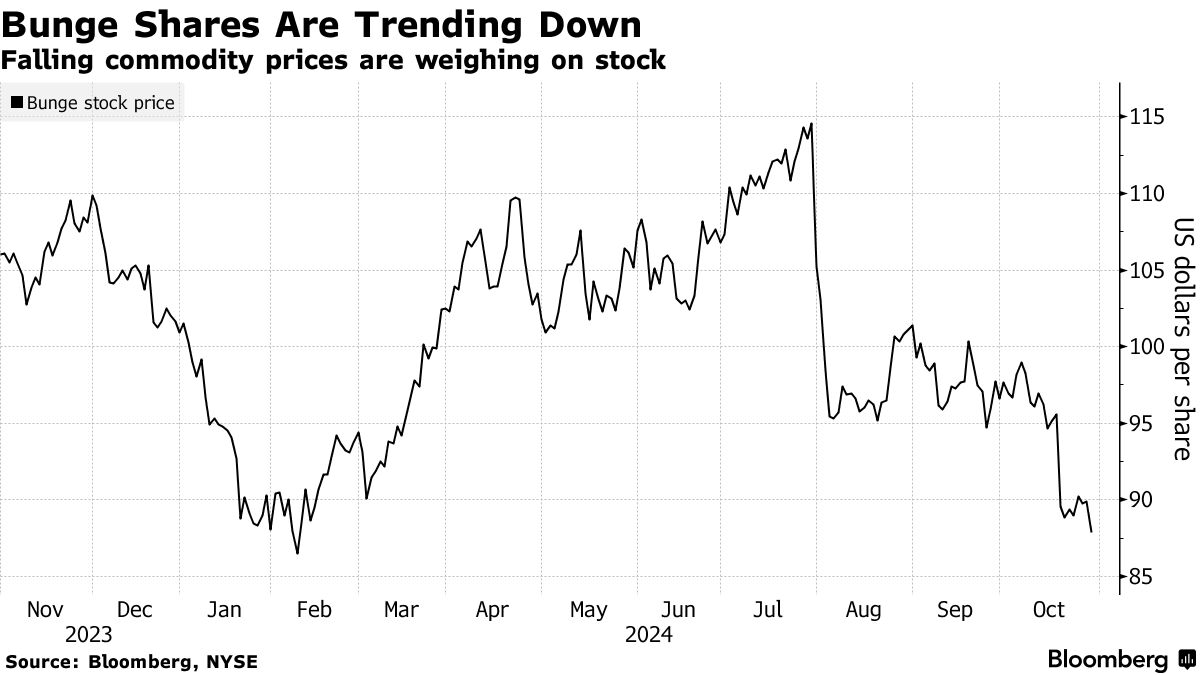

Bunge shares closed 2.3% lower in New York. The stock is down 15% in 2024, heading for its first annual decline in six years, compared with a 22% gain for the S&P 500 index.

Bunge — which belongs in the select group of companies that dominate the supply of agricultural commodities globally — has seen profits erode from the record levels seen over the last couple of years, when it benefited from the trading opportunities created by a combination of tight supplies and Russia’s invasion of Ukraine.

Prices for soybeans, corn and wheat have hovered around the lowest levels since 2020 following abundant harvests including in the US. The profits companies such as Bunge make from processing soybeans into meal and oil — a key earnings driver — have also been pressured by increased crushing capacity in the US.

Demand for soybean meal — a key animal feed ingredient — has been strong amid rising profits for chicken producers. The company has also benefited from improved demand for soybean oil after a surge in prices for palm oil, which can also be used as a feedstock for cooking and renewable fuel production. Delayed farmer sales in Argentina — the world’s largest soybean processing country — have helped sustain crushing margins in the US, the company said.

Bunge said it now expects its full-year earnings to be “at least” $9.25 a share, which compares with a previous forecast of “approximately” $9.25.

For almost 30 years of expertise in the agri markets, UkrAgroConsult has accumulated an extensive database, which became the basis of the platform AgriSupp.

It is a multi-functional online platform with market intelligence for grains and oilseeds that enables to get access to daily operational information on the Black Sea & Danube markets, analytical reports, historical data.

You are welcome to get a 7-day free demo access!!!

Read also

Abbey Commodities – General Partner of BLACK SEA GRAIN.KYIV-2026

Corn prices in Ukraine dropped to $212–213/t

Export Logistics Reset 2026: Rail Tariffs, Capacity Pressure and New Trade Reality

India’s palm oil imports rose 51% in January, reaching a four-month high

Morocco expects grain harvest to double following heavy winter rains

Write to us

Our manager will contact you soon