Bread prices soar in Korea despite wheat drop due to monopoly and delivery costs

According to industry sources on the 2nd, the controversy over ‘breadflation’ (bread + inflation), which started with SukaWorld’s 990 won salt bread, continues. Even though bread can be bought for less than 1,000 won each, the prices of bread sold at mass-produced franchise bakeries, convenience stores, and local bakeries are deemed expensive, prompting a backlash from self-employed individuals. Salt bread is sold in the market for around 3,000 to 4,000 won each.

SukaWorld apologized the previous day, saying it had ‘never blamed self-employed individuals’ regarding the controversy. On the 30th of last month, SukaWorld opened a pop-up store for an ETF bakery in Seongdong, Seoul, selling salt bread and bagels for 990 won each. At that time, SukaWorld stated that it had reduced distribution costs by sourcing raw materials directly and simplified the shape and packaging of the bread, adding that it prepared this initiative to respond to breadflation.

Some in the industry point out that SukaWorld’s actions overlook the fact that there are many factors, aside from the cost of materials and supplies, that determine bread prices. For example, it is said that even if the price of the main ingredient, wheat, drops, it is difficult to reflect this directly in actual bread prices.

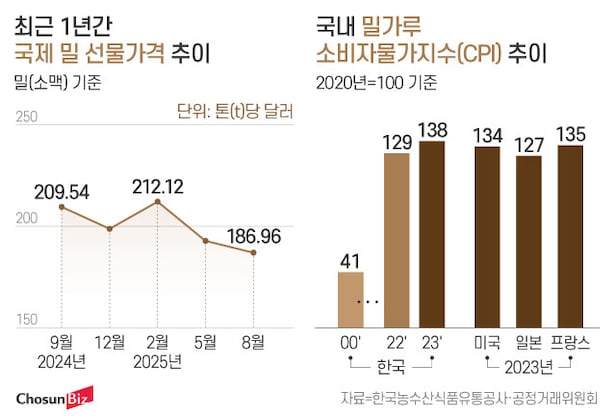

According to the Korea Agro-Fisheries & Food Trade Corporation (aT), the price of international wheat futures rose to $212.12 per ton due to the effects of the Russia-Ukraine war in February, which is about 295,000 won. However, it fell to $186.96 per ton (about 265,000 won) starting last month.

Under these circumstances, the consumer price index (CPI) for flour was reported at 138 in 2023. In 2000, it was the lowest among major countries at 41, but by 2023, it surpassed that of the United States (134), Japan (127), and France (135). The flour CPI is calculated by averaging the price fluctuations compared to the base year of 2020.

An industry insider stated, ‘The cost of flour accounts for about 20 to 25% of the bread’s cost,’ adding, ‘The rest consists of materials and supplies like butter, milk, eggs, sugar, along with packaging, logistics, and labor expenses. Even if the price of flour decreases, the increases in other materials and supplies and logistics and labor expenses are greater, making it impossible to lower bread prices.’

In this situation, the industry argues that mass-produced bread sold at convenience stores and franchises is structurally more expensive. According to the Fair Trade Commission’s report on ‘Market Analysis of the Baking Industry and Evaluation of Major Regulatory Competition Effects,’ sales management expenses (including discounts and support for franchises) account for 42.4% of the cost of franchise bakery bread, which is higher than the costs for raw materials (31.6%), labor (16.8%), and manufacturing expenses (9.4%).

The supply structure is also cited as a reason why the price of mass-produced bread cannot be lowered. In the distribution network from headquarters to franchisees to suppliers, suppliers must meet specified quality, packaging, and quantity, and inevitably shoulder the burden of returns and inventory. Especially since bread, being a perishable item, has a short shelf life, the costs of managing inventory are relatively high. An industry insider noted, ‘Bread supplied to convenience stores is often supplied in large, long-term contracts,’ and added, ‘It is more affected by the overall logistics structure than by the price of materials and supplies.’

Furthermore, the mass-produced bakeries of franchises like Paris Baguette, Paris Croissant, and Tous Les Jours effectively dominate the market, and the concentration of sales in a few brands restricts competition, making it difficult to lower bread prices. Professor Kim Jeong-sik from Yonsei University stated, ‘To lower overall bread prices, competition must be promoted, but the domestic bread market is virtually monopolized by a few franchises,’ adding that ‘this structure weakens the incentive to engage in price competition.’

For almost 30 years of expertise in the agri markets, UkrAgroConsult has accumulated an extensive database, which became the basis of the platform AgriSupp.

It is a multi-functional online platform with market intelligence for grains and oilseeds that enables to get access to daily operational information on the Black Sea & Danube markets, analytical reports, historical data.

You are welcome to get a 7-day free demo access!!!

Read also

Abbey Commodities – General Partner of BLACK SEA GRAIN.KYIV-2026

Export Logistics Reset 2026: Rail Tariffs, Capacity Pressure and New Trade Reality

ABIOVE has spoken out against the EU’s proposal to phase out soy-based biofu...

Jordan purchased 50 thsd tons of barley in tender

Brazil, Argentina ship 7 mil mt of soybeans to China for Feb-April

Write to us

Our manager will contact you soon