Australia: Tariffs temper new-crop outlook for GM canola

Canola’s unassailable place in southern Australian crop rotations is expected to buffer new-crop area from a major fall as tariffs aimed at Canada send ripples through global oilseed markets.

Most exposed price-wise is genetically modified canola, which forms a greater proportion of the crop in Western Australia than in eastern states.

GM canola exported from Australia could well face aggressive pricing from Canada, which looks unlikely to be selling any new crop over the 25-percent tariff wall and into the United States, normally its biggest customer for meal and oil.

While China has a 100pc tariff on Canadian canola oil and meal, seed has retained its tariff-free status.

What happens between now and the world’s major canola-harvesting months of August to October in Canada, and October to December in Australia, is anyone’s guess as action and reaction runs rife between the US, Canada and China.

Australia’s biggest market is in Europe for non-GM canola, and this is expected to preserve canola’s proportion of winter-crop area in eastern states.

While prices for GM and non-GM canola alike will feel the tariff fall-out, their agronomic benefits as the broadleaf of choice to grow in rotation with wheat in WA and New South Wales, Australia’s two biggest cropping states, is not at risk.

As outlined in a February 5 Grain Central article published before China and the US imposed tariffs on Canadian product, Canada in 2023 exported 3 million tonnes (Mt) of canola oil and 3.5Mt of meal to the US, and 4.6Mt of seed and 1.8Mt of meal to China.

Most of WA’s grainbelt has had a surprising amount of rain in the week to today; startlingly high figures include 65mm at Ardath and 96mm at Cranbrook, while most locations recorded more like 10-30mm.

For some growers, particularly in the milder Albany Port Zone, plans are afoot to get some early canola into the ground late this month or early next to make the most of the wet topsoil and topped-up subsoil.

Farmanco grain marketing consultant Don McTaggart said canola area in WA may go down a little on the softer outlook for canola pricing.

“Hectares aren’t in until they’re in, but people would be potentially looking at planting a bit less,” Mr McTaggart said.

Yield potential based on plant-available water, and how canola stacks up on price against the state’s other major non-cereal crop, lupins, could see canola’s gross margin not be so bad after all, even if GM prices look to be softer.

“Throughout any given year, price signals change, and a lot of people do pretty much look to long-term rotations for multi-year agronomic benefit.

“At the margin, there could be a bit of a change in hectares, but people appreciate the benefits of a long-term rotation will outweigh flip-flopping over prices.”

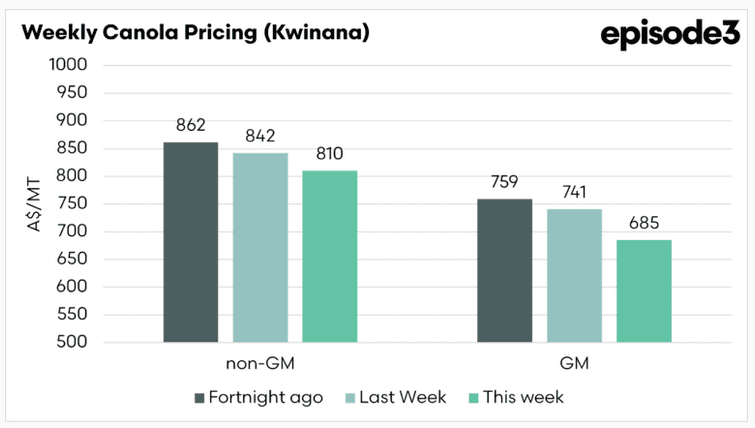

Graph 1: Comparative canola pricing as at 12 March 2025. Source: episode3

While the US tariff on GM canola may moderate price expectations, Mr McTaggart said it will not cause WA growers to make a wholesale switch out of canola.

“There will be no-one that will cut canola out.”

Farmanco’s WA client database indicates 75pc of area is GM, and because of the need to stay on top of weeds in the rotation overall, some growers will plant nothing else.

“I haven’t had anyone in the Geraldton zone grow non-GM canola.”

Numerous companies supply canola seed to Australian growers, and all are believed to be well stocked with GM varieties which can be used in conjunction with various herbicides, as well as non-GM varieties.

Sales of both types of seed are seen as being typical for this time of year, and are expected to spike once planting rains arrive and indicate whether growers should opt for long, medium or short-season varieties.

“Although we are closely watching the canola spot price market as well as the forward contract market for the 2025 harvest, we also know that we can’t control what is happening,” Nuseed Australia general manager Rebecca Underwood said.

“Because of the increased volatility and uncertainty at a geopolitical level, we do advise growers to focus on what works best for their farming system from an agronomic perspective to maximise returns.”

On a national level, Delta Ag Marketing general manager Mick Parry said Europe’s strong price for rapeseed, which reflects the market for non-GM seed, has been stronger than the GM market, which has absorbed concerns about the deteriorated bilateral relationship between the US and Canada.

“I think canola’s marketing outlook is probably the most at risk,” Mr Parry said.

“Canola marketing has been hit hard because of the Canadian canola price…and the European price has been much stronger.”

In eastern Australia, non-GM delivery points are believed to outnumber GM ones, and in Victoria in particular, non-GM canola is expected to hold ground, while some GM area may go into pulses.

In his March 10 Agri Commodities Weekly Alert posted , CBA analyst Dennis Voznesenski stepped through the latest barriers to free trade in oilseeds, including China banning a number of large traders from importing US soybeans on top of tariffs recently imposed.

“China has also implemented tariffs on Canadian canola oil.

“The lack of tariffs on Canadian canola seed shows hesitancy by China to further constrain its oilseed sourcing options.”

In his article published on March 12, Episode 3 analyst Andrew Whitelaw said US and Chinese tariffs on Canadian canola oil and meal will affect “a huge chunk” of Canada’s exports of both products.

“Tariffs will make these markets unattractive, which will mean that they will be looking to move canola to different markets, which may be directly competing with Australian trade,” Mr Whitelaw said .

“Our non-GM trade into Europe is important, with the majority of our non-GM canola going there.

“We will likely see a continuation of that large spread between Non-GM and GM for at least a little while.

“Uncertainty has pulled the market down, and this is being felt in our prices here.”

In a March 8 joint statement, the Canola Council of Canada president and chief executive officer Chris Davisonurged the Canadian Government “to immediately engage with China with a view to resolving this issue” of tariffs.

Canadian Canola Growers Association president and CEO Rick White said Canadian canola farmers were “facing an unprecedented situation of trade uncertainty from our two largest export markets only weeks before planting begins”.

“The impact of the federal government’s trade policy decisions is now playing out at the farmgate, making it imperative that government respond with a plan for financial compensation commensurate with the losses incurred.”

Canada’s canola growers have called out the Canadian Government’s tariffs on Chinese electric vehicles, steel, and aluminium as being cause for China’s retaliatory tariffs on Canadian canola oil and meal.

“The impact of the Federal Government’s trade policy decisions is now playing out at the farmgate, making it imperative that government respond with a plan for financial compensation commensurate with the losses incurred,” Mr White said.

For almost 30 years of expertise in the agri markets, UkrAgroConsult has accumulated an extensive database, which became the basis of the platform AgriSupp.

It is a multi-functional online platform with market intelligence for grains and oilseeds that enables to get access to daily operational information on the Black Sea & Danube markets, analytical reports, historical data.

You are welcome to get a 7-day free demo access!!!

Read also

Abbey Commodities – General Partner of BLACK SEA GRAIN.KYIV-2026

Black Sea & Danube Barley Market at a Turning Point: Demand Pressure and Regi...

US Supreme Court rules Trump’s emergency duties illegal

Mercosur: Protective measures for European agriculture

US makes concessions on pulses in new trade deal with India

Write to us

Our manager will contact you soon