Australia: Quota debut likely as return of India’s pulse tariffs looms

Australian exporters are bracing for the return of tariffs on Australia’s two biggest pulse exports, chickpeas and lentils, from April 1.

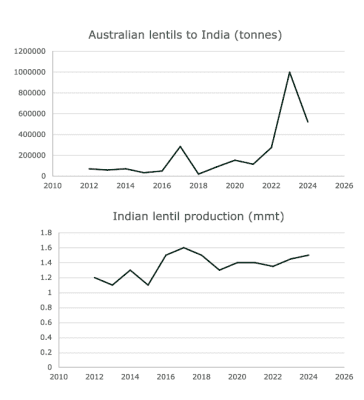

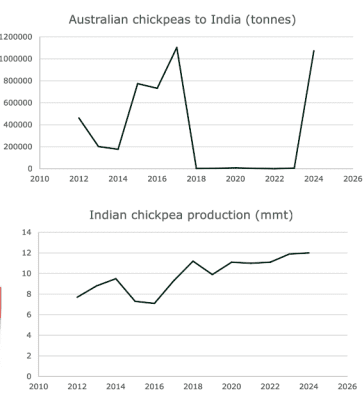

The scheduled reinstatement of tariffs follows a period without them that started in 2021 for lentils, and a window for chickpeas that opened in May last year.

It has allowed 1 million tonnes (Mt) of tariff-free Australian chickpeas, or more than half the current crop seen by ABARES at 1.9Mt, to be shipped to India in the December quarter, and trade sources estimate another 400,000t in the current quarter.

On lentils, exports from a smaller-than-average crop seen by ABARES at 1.1Mt have also made headway into India ahead of the scheduled tariff return, accounting for 131,595t of December-quarter shipments which totalled 311,864t.

While Bangladesh, Pakistan, Sri Lanka, and the United Arab Emirates are also bulk markets for Australian chickpeas and lentils, India is the major by far.

What the return of tariffs may mean was the subject of an Austrade Indian Pulses Briefing held on Friday at the Australian High Commission in New Delhi.

It canvassed the impact of the Australia-India Economic Cooperation and Trade Agreement, or ECTA, which came into force in December 2022, and provides a 50-percent tariff reduction on 150,000t per annum of lentils.

Australia’s New Delhi-based Agriculture Counsellor Kiran Karamil told the briefing that how the quota would be divided between exporters of Australian lentils was yet to be determined.

“The department is working through it at the moment with the potential of tariffs being reintroduced,” Mr Karamil told the briefing, which was attended virtually by a number of exporters of Australian pulses and others.

“We don’t have a definitive answer yet.”

The possibility exists that the Indian Government may extend the tariff-free period for one or more major imported pulses, namely lentils, chickpeas, and yellow peas.

It has already extended tariff-free periods for yellow peas and lentils, but not chickpeas, to take them to their current scheduled end dates.

“The discussion amongst the Indian trade seems to be that the duty-free period may lapse which is not a good thing, but I guess the benefit is that at least we have the 50pc reduction of the tariff-rate quota under ECTA,” Mr Karamil said in relation to lentils.

Mr Karamil said the picture for chickpeas could become clearer as soon as April, once the Indian Government had a better handle on the size of the rabi crop and stocks.

“Maybe around April-May, similar to last year, we may see duties come back down again.”

Yellow peas, with Canada and Russia as major suppliers, have been entering India tariff free since December 2023, and the impact of the closing of that window on February 28 may have some bearing on whether the tariff-free period for chickpea and/or lentils is extended.

“That will provide a very strong signal around what will happen,” Mr Karamil said.

“Last year, when chickpea production was looking grim…they opened the levers on yellow peas to see if that had an impact on inflation.”

Mr Karamil said the small impact on India’s domestic prices allowed the chickpea tariff to be suspended last year.

Also addressing the webinar was John Southwell, Australian Senior Trade and Investment Commissioner for food, beverage, agricultural and consumer products into India and South Asia.

He said firming pulse and vegetable prices have seen India buck the global trend of declining food inflation.

“This is the chief concern of the Indian Government,” Mr Southwell said.

“Unless India becomes incredibly productive, the gap between domestic production and demand will continue to grow.”

Indian policies in recent years have been implemented to stimulate domestic black gram, chickpea, lentil, and pigeon pea production, and Mr Karamil said current policies supported increased production of black gram, lentils, and pigeon peas.

“We’re going to see a big drive around those commodities in particular,” Mr Karamil said.

The Indian Government’s aim is to be as self-sufficient as possible for its population of 1.437 billion people, including 234M, or 16 percent, below the poverty line.

Against that is its desire to support workers in agriculture, 46pc of India’s labour force, working on holdings of less than 2ha, which account for 86pc of India’s farms.

“We’ve got the Indian Government looking to support those farmers,” Mr Karamil said, adding that good prices available to farmers for their pulses as against affordable food for the wider population was “a balancing act”.

“The impacts we see because of various policy decision is to support one or the other.”

For almost 30 years of expertise in the agri markets, UkrAgroConsult has accumulated an extensive database, which became the basis of the platform AgriSupp.

It is a multi-functional online platform with market intelligence for grains and oilseeds that enables to get access to daily operational information on the Black Sea & Danube markets, analytical reports, historical data.

You are welcome to get a 7-day free demo access!!!

Read also

Abbey Commodities – General Partner of BLACK SEA GRAIN.KYIV-2026

Export Logistics Reset 2026: Rail Tariffs, Capacity Pressure and New Trade Reality

ABIOVE has spoken out against the EU’s proposal to phase out soy-based biofu...

Jordan purchased 50 thsd tons of barley in tender

Brazil, Argentina ship 7 mil mt of soybeans to China for Feb-April

Write to us

Our manager will contact you soon