Ukraine is determined to become a global leader in frozen raspberry exports

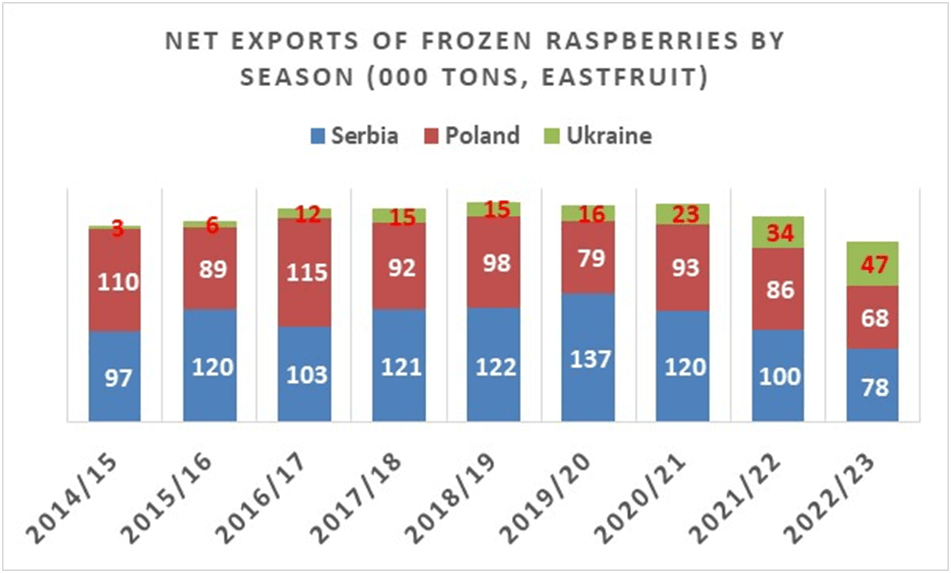

According to EastFruit analysts, Ukraine has recently taken a huge step towards becoming the world leader in exports of frozen raspberries, which is amazing as it is happening despite the Russian aggression in Ukraine. Over the past five seasons, the volume of frozen raspberry exports from Ukraine has grown by 3.1 times. During the same period, the global leader Serbia reduced its net exports of frozen raspberries by 35%, and Poland by 26%. Basically, each year Ukraine has been boosting exports by 40-45%, taking part of the market share away from Poland and Serbia.

“Ten years ago, Ukraine almost did not export any frozen raspberries. In Europe and worldwide, there were essentially two countries that dominated the market – Serbia and Poland. Ukraine accounted for less than 1% of what Serbia and Poland exported, basically have no impact on the market. However, in 2018, Ukraine got noticed, even though its export volumes were incomparable to those of the leaders – only about 5% of their total volume. However, at the end of the 2022/23 season, raspberry exports from Ukraine exceeded 50% of what Serbia exported and 43% of Poland’s total frozen raspberry exports. I emphasize the word ‘total’ because nearly 37% of raspberry exports from Poland were re-exports, predominantly of Ukrainian raspberries. Therefore, if we consider net exports, Ukraine has come quite close to Poland in terms of export volume,” says Andriy Yarmak, an economist at the Food and Agriculture Organization (FAO) Investment Centre.

He notes that these figures also include exports of frozen blackberries, but its volume is relatively small. Also, according to Andriy Yarmak, Serbia, like Poland, trying to maintain its position in the global frozen raspberry market, also increased imports of this berry from other countries, including from Ukraine, for further re-exports. True, the rate of increase in Serbia’s raspberry imports was lower than that of Poland and re-exports accounted for only about 13% of all external sales. At the same time, Ukraine did not import frozen raspberries at all.

As we can see in the graph, net exports of raspberries from Serbia have been declining for three seasons in a row, and from Poland – for four seasons in a row. At the same time, raspberry exports from Ukraine are growing every year, even in years when prices are not too high, and demand remains weak.

“It must be mentioned that in the ranking of frozen raspberry exporters in terms of export value, Ukraine is still very far from Poland, not to mention global leader Serbia. And this is very bad for Ukraine because low export value negatively the entire industry, especially growers. Ukrainian farmers growing raspberries are not at all happy today, because prices in the current season often did not even cover the costs of growing and picking. However, this is part of the traditional cyclical nature of the raspberry market. Moreover, this is a definite lesson for Ukraine, which traditionally relied on selling raspberries at the lowest price to Poland, where a significant part of the added value remained. This year, Ukrainian freezers went even further, creating a new quality category for frozen raspberries, which further aggravated the price situation. If the industry invested at least minimal efforts and funds in marketing and quality improvement, it could export raspberries at almost twice the price. In other words, Ukraine is now actually giving away about $100 million US dollars to other countries, primarily Poland, when exporting raspberries, although it could create new jobs and dramatically increase the profitability of the industry by investing in sorting, packaging, and marketing!” – says the FAO expert.

Currently, many companies in Ukraine, for very obvious reasons, are in no hurry to invest. After all, Ukraine is still partially occupied by Russian aggressors, who continue missile attacks on civilian infrastructure. This also leads to a labor shortage because many of the country’s residents have become refugees in other countries, and men have gone to the frontlines to defend their country.

“Nevertheless, I would like to hope that in the near future Ukraine will cope with both the aggressor and the problem of added value when exporting raspberries. We expect industry consolidation, appearance of optical sorting lines for frozen berries in the country and increased efforts to promote exports of high-quality frozen products to the markets of the USA, Canada, Japan, and other countries of the world, which pay 2-3 times more for raspberries than Poland. By the way, if Poland bans imports of fresh and frozen raspberries from Ukraine, this will only help the Ukrainian industry – because in this case they will have to invest in quality and marketing. This means that Ukraine will get an additional $100 million USD in export earnings, which can be reinvested in the further expansion of raspberry production and freezing,” says Andriy Yarmak.

It should be noted that Ukraine’s active expansion into world markets led to a decrease in the exports of frozen raspberries from Chile, and already in the 2022/23 season, Ukraine overtook this country in the world ranking of exporters. In addition, Ukraine was able to bypass Mexico, which is also very actively increasing production of frozen raspberries due to its proximity to the world’s largest buyer – the United States. Raspberry growers from Morocco also sharply increased production and export volumes in the last five years. This means that the capacity of the global frozen raspberry market continues to grow, as does competition.

Write to us

Our manager will contact you soon