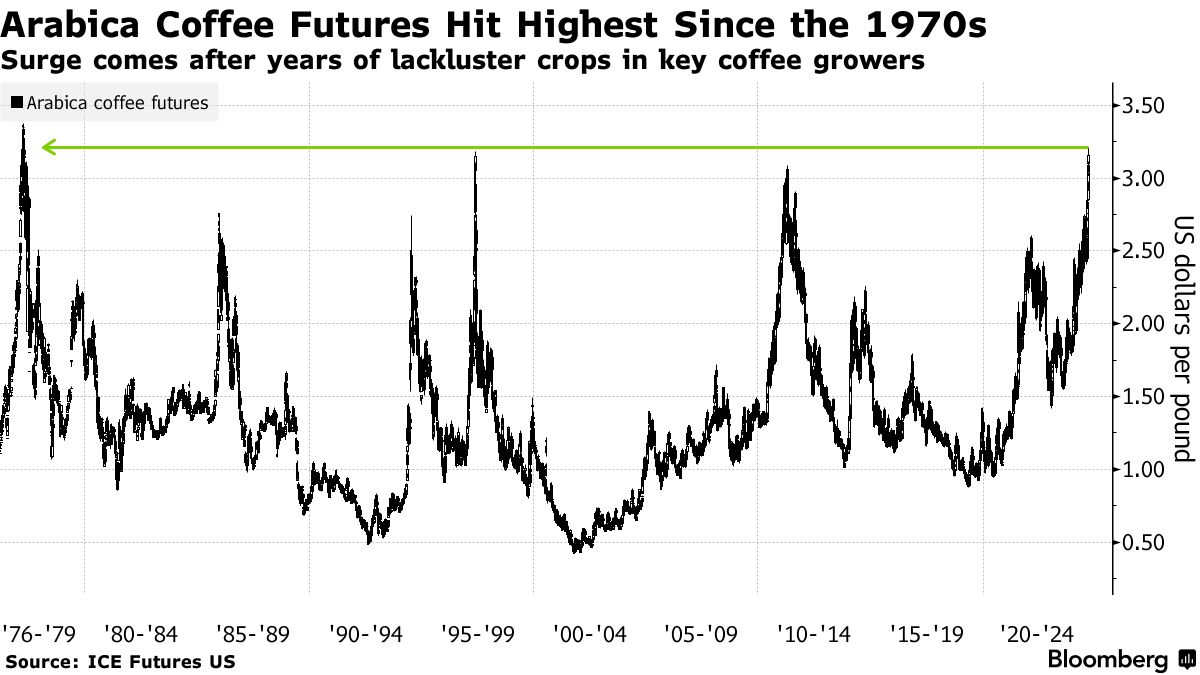

Coffee Gets Even Pricier as Arabica Jumps to Highest Since 1977

Coffee futures extended their rampant rally to the highest in more than four decades in New York on global supply worries, threatening to further raise costs for consumers.

Arabica beans — the variety favored for specialty brews — climbed as much as 3.9%, hitting the highest since 1977. They’ve jumped almost 70% this year.

A severe drought earlier this year in Brazil has fueled worries about the country’s output. That comes on top of concerns about another bean variety produced in Vietnam, after a key coffee belt was hit by dryness during the growing period and heavy rains arrived at the start of harvest.

The countries are the two biggest global coffee growers, with Brazil exporting mostly the premium arabica bean and Vietnam leading the market for the cheaper robusta.

The move is set to add to the pain facing cafes and roasters, ultimately boosting costs to consumers. Along the supply chain, sellers have raised prices and scrapped discounts to protect their margins. Nestle SA, the world’s biggest coffee maker, said in November that it will raise prices and make packs smaller to blunt the impact of more expensive beans.

“The rally is due to a number of complex circumstances,” including concerns about Brazil’s output in the upcoming 2025-26 season, as well as shipping and logistical challenges, Rabobank analyst Carlos Mera said.

Other factors are the uncertainty over the start date for the European Union’s deforestation rules and the front loading of sales to the US ahead of potential trade tariffs under a Trump administration, he said.

Arabica was last up 2.6% at $3.17 a pound in New York, on course for a sixth straight daily increase. The advance has pushed futures’ 14-day relative-strength index well above 70, a level that can suggest that the market has become overbought.

Coffee growers in Brazil are not selling large volumes at the moment, broker Thiago Cazarini said. Producers have already sold a large percentage of the current harvest, and that leaves buyers with tight supplies until the next crop is harvested starting in May.

The recent arabica supply concerns come on top of several seasons of lackluster crops not only in Brazil but also in other key coffee growing countries. Second-largest arabica producer Colombia is still recovering from impacts of dry El Niño weather earlier this year, while recent heavy rainfall brought concerns over potential damage to crops in countries including Costa Rica and Honduras.

The increased costs of hedging — due to higher margin calls — and the possibility of producer defaults have contributed to panic buying recently, analysts at coffee trader Sucafina SA wrote this week.

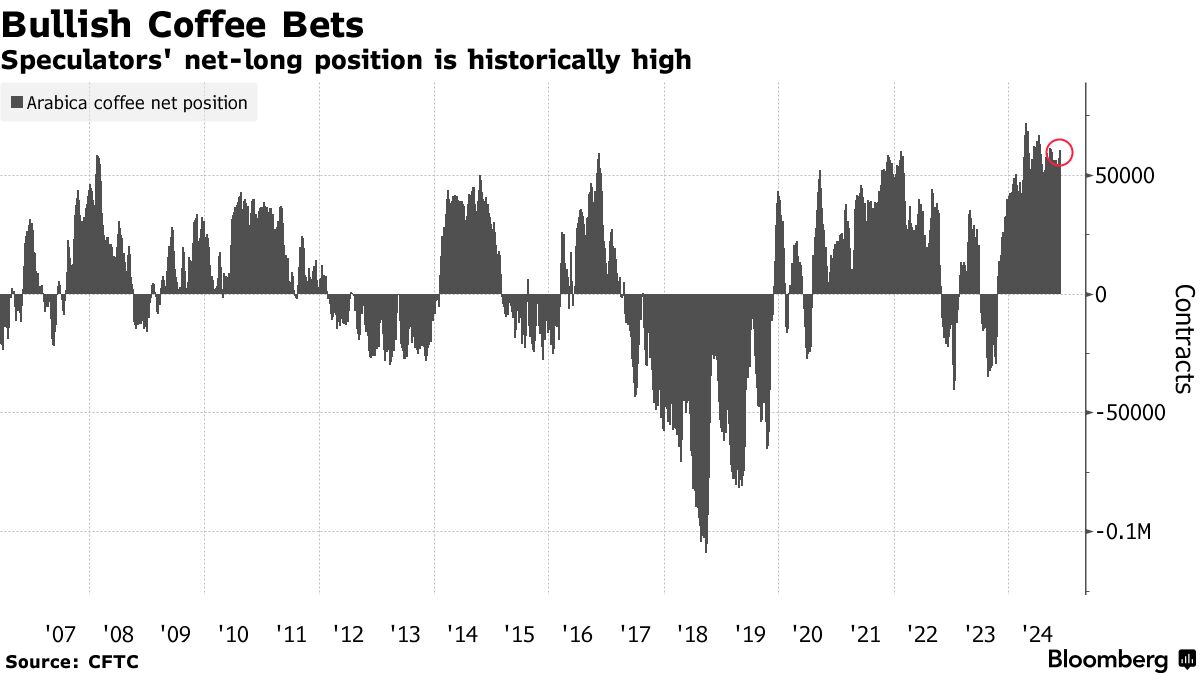

This year’s rally has been accompanied by fund managers holding large bets on higher prices. While speculators’ net-long position in arabica is below a peak set earlier in the year, bullish wagers remain at a historically high level, Commodity Futures Trading Commission data show.

Robusta coffee, the more budget-friendly type of coffee that’s used in instant drinks, has also soared this year, rising about 88% in London.

In other soft commodities markets, raw sugar climbed on Wednesday, while cocoa edged down in New York.

Read also

Black Sea & Danube Barley Market at a Turning Point: Demand Pressure and Regi...

Ukraine sharply reduced walnut exports

Global grain harvest hits record highs, but balance remains fragile — IGC

Spanish football club unveiled a uniform made from orange fibres

Forecasts of precipitation in the US and Argentina and improved weather in the Bla...

Write to us

Our manager will contact you soon